How to Prepare a Business Budget

One of the primary challenges facing a small business owner is uncertainty about the future. (It is also what makes entrepreneurship exciting). We may have an amazing product or service, but we can’t be sure whether this will actually translate into a profitable business model. A budget for your small business is an excellent tool to manage uncertainty and, contrary to popular belief, can actually be fairly straightforward to prepare, particularly for small businesses that do not have to worry about different departments, product lines and geographic areas .

A budget, very simply, is a tool that helps you predict your sales, expenses and profitability as well as your cash flow needs. It is based on estimates, which in turn are based on a combination of experience, history and industry knowledge. In terms of presentation, a budget should essentially mirror your financial statements and will include the following main categories:

Profit and Loss Budget

Sales:

This is perhaps the most important and the most difficult number to determine. If you have prior years sales history, that is usually a good starting point. You could simply use prior year's sales and estimate a growth percentage. Alternatively, if you are in a service based business, you could break down your sales by existing clients and anticipated new clients. Another method is to determine the size of your market (available through industry publications etc.) and estimate what share of that market you can realistically hope to capture. The more detailed your sales forecast assumptions, the better your budget will be able to react to new information.

Direct Costs/Cost of Goods Sold/Gross Margin:

These represent the direct costs relating to your product or service. For example the the direct expenses for a Public Relations Consultant include the cost of press releases, photography, costs relating to events etc. You can either use a fixed percentage based on history or industry knowledge or you can build up the costs based on specific campaigns or another natural division.

The difference between your sales and direct expenses is referred to as your gross margin. This is usually expressed as a percentage which can be used for future forecasting purposes.

Selling Expenses:

Any costs incurred to market your business are included in this category and comprise advertising, website related costs, commissions paid to sales people, business cards and other promotional materials, travel expenses and lead generation.

General and Administrative Expenses:

Basic overhead costs incurred to run your business including rent, utilities, insurance and office expenses are represented in this category. These are usually fairly easy to predict as they tend to stay the same (with standard increases) from year to year, and you often know what they are going to be in advance.

Financial Expenses:

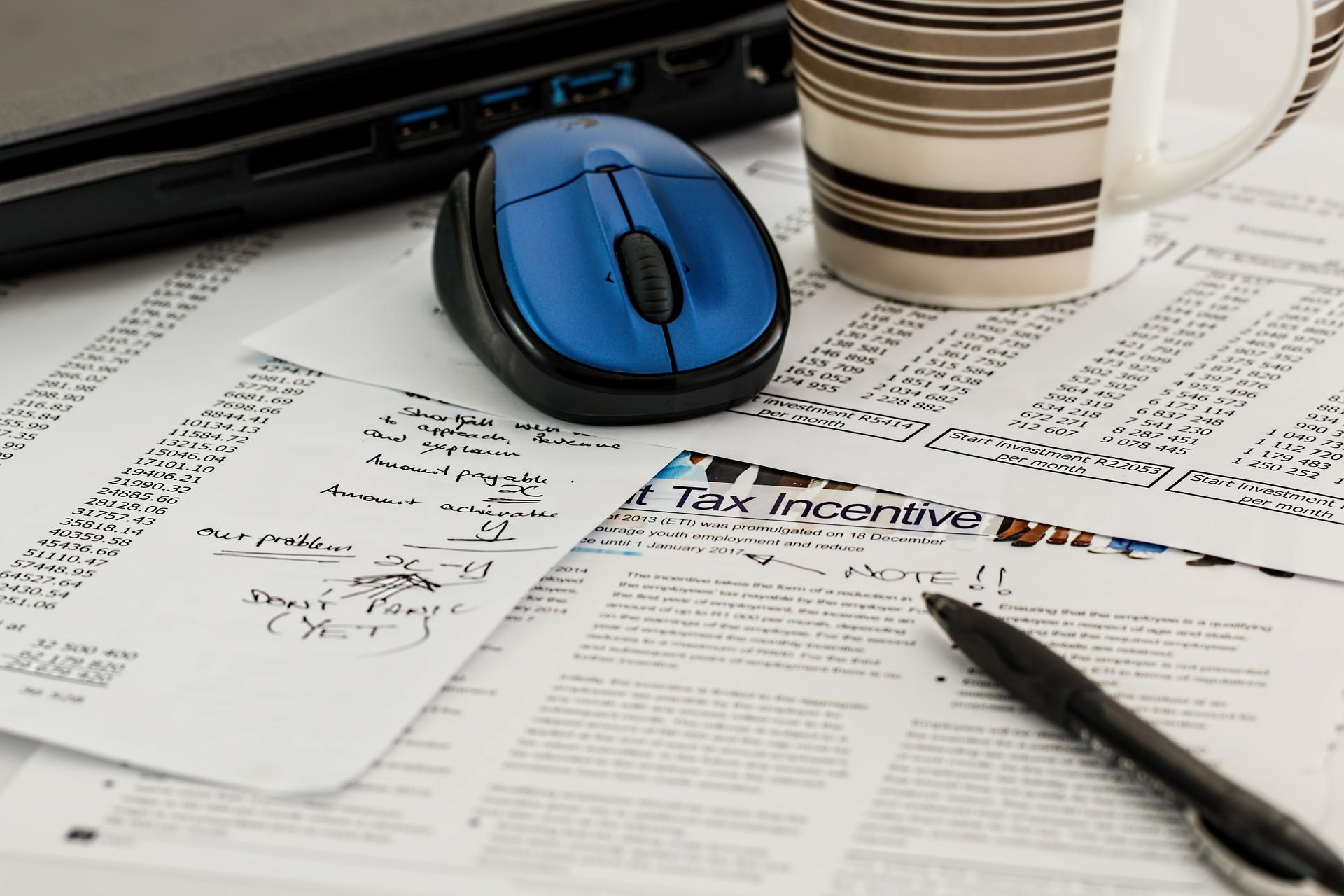

Bank and credit card charges, interest expense on lines of credit and loans and foreign exchange are usually included in this category. Credit card charges can usually be calculated as a percentage of credit card sales whereas interest expense is based on the interest rate and principal balance outstanding.

Income Taxes:

If you expect to be profitable it is important to estimate how much you will owe in business income taxes. In Canada, if you are a small business with less than $500,000 in net income, you can usually estimate income tax expense at approximately 20% of net income.

Net Profit:

Your net profit is calculated by deducting your total expenses from your total sales. This is arguably the most important number in your budget as it lets you know whether you are going to incur a loss, breakeven or generate a profit. Many startups incur significant losses in their first few years of operations, so not being profitable initially is not necessarily problematic as long as you have a source of cash flow to cover your losses and you anticipate growth. It took Amazon (and numerous startups) years to become profitable and generate cash flows. They did however have sources of cash through loans and venture capital that allowed them to continue to operate.

Balance Sheet Budget:

A balance sheet budget helps you project your cash needs. All the relevant asset categories including cash, inventory, accounts receivable, deposits, fixed assets and liabilities including accounts payable, payroll and loans payable. The difference between the two is represented by your profits and accumulated earnings. When it comes to building a balance sheet, the cash figure will be the “plug” and lets you know how much cash your business will generate or lose. If you have a cash flow deficit, you will need to ensure that you have access to other sources of cash.

Considerations when Preparing your Budget:

The more history your business has, the more accurate your assumptions are likely to be.

It is always good to be realistic, but conservative when preparing your budget.

It is important to estimate a salary for the yourself, the business owner, as this is an essential cost of running the business and is key to accurately representing the expenses of the business.

Budgets need to be tracked! This is done by comparing your actual results to your budgeted resulting and analyzing the differences.

Ideally you should prepare your budget by month. This allows for a better understanding of differences.

Budgets should be dynamic. i.e. as assumptions change your budget should be updated to reflect these changes.

Automate the budget process as much as possible. This is fairly easy to do using excel. I like to use an assumptions page that feeds into the income statement and balance sheet pages. That way I can update the whole budget by simply tweaking the assumptions page. Wherever possible, use formulas.

Ensure that your budget looks reasonable. If your expenses seem to high then you need to use your budget to decide which costs can be reduced. If your profit seems high (this actually does happen) use the excess funds to grow your business.

Although a budget is ultimately an estimate, if used properly, can be an invaluable tool in helping a business owner predict the direction of their business, control cash flows ensure that they are pricing their services or products correctly and ultimately contributes to more optimal decision making. If you are uncertain about where to start, might make sense to consult your accountant.

Ronika Khanna is an accounting and finance professional who helps small businesses achieve their financial goals. She is the author of several books for small businesses and also provides financial consulting services.

Subscribe to our biweekly newsletter to receive articles, tips, tools and special offers for small businesses.

"QuickStart Your QuickBooks" is the ultimate guide for Canadian businesses looking to master QuickBooks Online (QBO). This comprehensive 250-page book transforms beginners into confident intermediate users, offering step-by-step instructions on everything from data migration and daily tasks like invoicing, to customizing your setup to handle Canadian sales taxes. With no prior accounting knowledge necessary, this guide includes screenshots, best practices, and essential reports to help you increase profitability and take control of your finances. Dive into QuickBooks with confidence and ease, and let "QuickStart Your QuickBooks" streamline your business operations.

Download your free QBO Set Up Checklist