10 Year End Financial and Tax Tips for Your Small Business

As the end of the year approaches, some of us find ourselves overwhelmed by top 10 lists, the shopping masses and endless renditions of Christmas Music. Businesses tend to experience a slowdown, which makes it the perfect time for small business owners to take a closer look at their overall business, financial and tax situation. When you are not buying gifts for your customers, family and friends, a review and analysis of your business will allow you to optimize your current financial situation, implement some beneficial changes that can help avoid last minute tax preparation stress and also prepare for the future.

9 Tips For Managing Your Customer Receivables

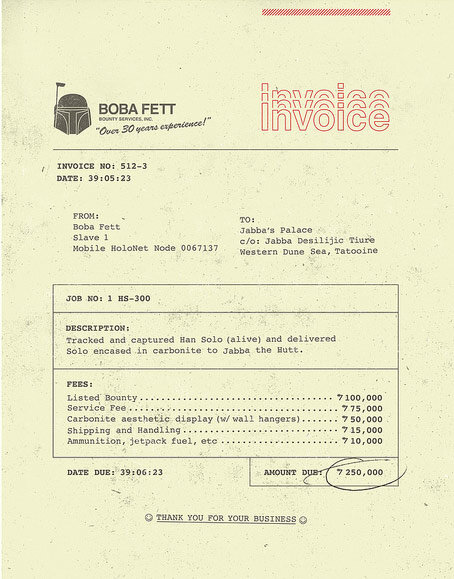

Any sales that occur within a business where payment is not made up front (eg. retail) or in advance of the sale (eg. down payment for a car), is reflected as an “Accounts Receivable”, which is accounting terminology for amounts owing by customers to a business. It is good to have accounts receivable, as this means you are generating sales. The downside, however, of having accounts receivable is that it represents cash that you don't have now, and along with that comes the possibility that your customers won’t pay you. Luckily a good system to manage your accounts receivable will help to reduce the number of non paying customers thereby avoiding bad debts. Below are some steps to help manage and collect on your accounts receivable:

Deferred Revenue and its Impact on your Small Business

Most small business owners are familiar with the concept of revenues, which is essentially the total sales of their product or service, to customers and clients, prior to deducting any costs. Revenues are a crucial component of business’ profit and loss statement and it is essential that they are accurate so that the business owners may effectively analyze the profitability of their businesses. Additionally there are third parties for which the accuracy of the revenues, and corresponding financial statements, is essential for effective decision making. Third parties include tax authorities, banks, partners and key employees (on which remuneration/bonuses might be based).

Should New Business Owners Register for GST/HST?

The Goods and Services Tax or GST is a consumption tax that is charged on most goods and services sold within Canada, regardless of where your business is located. Subject to certain exceptions, all businesses are required to charge GST , currently at 5%, plus applicable provincial sales taxes. A business effectively acts as an agent for Revenue Canada by collecting the taxes and remitting them on a periodic basis. Businesses are also permitted to claim the taxes paid on expenses incurred that relate to their business activities. These are referred to as Input Tax Credits.

Excel for Small Business Owners

As a confirmed excel nerd, there is something about large amounts of data that I am inextricably drawn towards . I suppose it has something to do with an affinity for organization combined with a love of numbers and the innate desire to solve problems. As an accountant and financial consultant , I am often presented with the task of organizing and analysing data into a format that allows for greater insight into my clients businesses . And although good accounting software is important for most small business owners, especially once they reach a certain size, a great deal of analysis and reporting is done most effectively in excel.

What is your Net Worth?

There comes a point in many people's lives when they want to find out what they are worth. This is much more difficult to quantify on a metaphysical level; however on a tangible level most people can figure out how much wealth they have created over time. The definition of net worth is simply the total of all your assets (what you own) less your liabilities (what you owe).

How to Prepare a Business Budget

One of the primary challenges facing a small business owner is uncertainty about the future. (It is also what makes entrepreneurship exciting). We may have an amazing product or service, but we can’t be sure whether this will actually translate into a profitable business model. A budget is an excellent tool to manage uncertainty and, contrary to popular belief, can actually be fairly straightforward to prepare, particularly for small businesses that do not have to worry about different departments, product lines and geographic areas .

A budget, very simply, is a tool that helps you predict your sales, expenses and profitability as well as your cash flow needs. It is based on estimates, which in turn are based on a combination of experience, history and industry knowledge. In terms of presentation, a budget should essentially mirror your financial statements and will include the following main categories:

How to Set Up a Small Business Accounting System

Many small business owners (myself included) tend to focus on the more glamourous aspects of their business eg. sales, marketing and product/service development. As a result, accounting often does not get the attention it deserves. In addition to the perception that an accounting system does not necessarily add value, it can also be a little intimidating. However, there are numerous benefits to setting up an accounting system and it can actually be fairly straightforward especially if you have some help with setting it up. A good accounting software tends to handle most of the complexity of accounting as long as the data is compiled and entered accurately.

Accounting for Non Accountants : Debit, Credits and Financial Statements

When people hear the term accounting, there is an involuntary reaction whereby the comprehension centres (the medical term) of their brains tend to shut down, and sleep mode is activated. This is unfortunate, as accounting, especially to a small business owner, can actually be quite interesting. It is one of the primary tools by which business owners and other interested parties can gage the success of their business, as well as identify areas that require attention andneed improvement. To understand accounting, business owners need to have a basic understanding of how it works (debits and credits) and it's results (financial statements), explained below:

4 Metrics to Help Improve Your Small Business Cash Flow

n a recent study by TD Bank Financial Group it was determined that one of the primary challenges facing small business was cash flow (The other two were managing clients and government red tape). This probably comes as no surprise to most small business owners, especially in the early stages. The simple answer to this problem would be a limitless source of cash. Since this is usually not possible, we need to do the next best thing: analyze our cash flow requirements and find the most cost effective and easily available solution for any shortfalls. Even the most successful business can find itself shutting its doors if it is not able to manage it's cash flow needs.

Below are 4 financial metrics, which if understood and monitored regularly, can actually help improve your business' cash flow:

The Many Hats of Self Employment

Being self employed comes with many benefits. You can sleep in, work in your pyjamas and go shopping in the middle of the day. You no longer have to report to a boss who doesn't really understand what you do or deal with mindless workplace politics. It all sounds wonderful, but unfortunately there are also many challenges. Small business owners have to deal with uncertainty and risk. They need to be disciplined and deal with the many demands that being self employed can impose upon us. In the early stages of self employment, most of us have to take on the responsiblity of fulfilling the administrative functions that you find in a more established business. Some of the skills that you need to develop are:

How to Update Quickbooks for the 2011 QST Rate Increase

Update: As of January 1st, 2012 the Quebec Sales Tax (QST Rate) which had gone up from 7.5% to 8.5% on January 1, 2011 will now increase to 9.5%. The effective sales tax in Quebec will go up from 13.925% to 14.975%. Since QST is calculated on the net amount + GST, the effective rate is actually 14.975% (and not 14.5%) . In other words the effective QST rate is 9.975%. The instructions below are equally applicable, except the new QST rate to enter is 9.5%.

On January 1st, 2011, Revenue Quebec will be increasing the QST rate to 8.5% (yay!), bringing the effective rate of QST to 8.925% andtotal sales taxes (GST and QST) to 13.925% (since the QST is actually charged on the net price + GST.) This will impact anyone who charges QST including small businesses and self employed individuals, and invoicing software and processes should be updated to reflect the change. Suffice it to say that there are no major changes in the application of the rates. For those of you using Quickbooks you will need to update the QST being charged on both sales and purchases.