10 Tips to Help you Keep More Cash in Your Business

One of the biggest challenges for many small business owners, particularly in the initial and growth stage, is ensuring that they maintain sufficient cash flow. Many businesses with great potential have suffered an untimely demise due to their inability to pay their suppliers, employees and revenue agencies. In many cases, this can be prevented through a better understanding of your small business’ cash flow requirements and making sure that you implement relevant processes that can handle cash flow issues as they arise.

What Are Bank Reconciliations and Why Every Business Should Do Them

Many small business and self employed owners take on the responsibility of doing their own accounting. You may do all of your own accounting from set up to preparing your own small business tax return OR you may have an accountant who simply takes care of your year end and tax reporting. Accounting software has made doing your own accounting much simpler and allows for most business owners to do it, regardless of whether they have some sort of accounting background. There is however a learning curve and certain accounting steps that not everyone is aware of and that are very important to ensure the accuracy of your books. One of these is are bank reconciliations.

4 Accounting Transactions that Use Journal Entries and How to Enter them in QBO

Accounting software has come a long way in the past few years. Although a good bookkeeper can be invaluable, It has become fairly easy for business owners and their support staff to take on the responsibility of entering day to day transactions while they employ accountants for the more complex aspects of their accounting and tax. While entering the majority of transactions in software, such as Quickbooks Online is fairly straightforward, there are transactions that require somewhat special treatment discussed below:

A Guide To Preparing the T2125 For Small Business Or Self Employed Owners

While being self employed comes with numerous benefits, there are also many challenges. One of the major ones is ensuring that you are aware of, and fulfill, your tax obligations on a timely basis. In the beginning these tax obligations can seem mystifying and somewhat overwhelming, but once you understand what needs to be done and you set up processes and reminders, it tends to become much more manageable. This in turn reduces stress as tax deadlines approach and can result in significant potential tax savings as you keep track of all your tax deductions and avoid interest and penalties.

What is Capital Cost Allowance and How Does it Impact Your Business

Frequently a client of mine will purchase a high ticket item such as a computer or a piece of furniture and will simply show it as an expense on their profit and loss. Since you purchased something that relates to your business, it should be considered to be a deduction and classified as an expenses.

Unfortunately, accountants and revenue agencies do not see it this way. From their perspective, an item that is purchased for a business, whose value extends beyond one year, is actually an asset that should be depreciated over the useful life of the asset. In other words, the expense that you can claim for the asset is only the portion of the asset that is used in the year that you claim it.

While accountants refer to the amount of the asset that is expensed each year as depreciation, Revenue Canada refers to this as capital cost allowance or CCA.

4 Alternatives for Preparing Your Small Business Payroll

Paying salaries to employees (or yourself) requires more than just determining the gross amount to be paid. The Canada Revenue Agency and Revenue Quebec require that employers calculate a variety of taxes on the salaries paid, remit them to the federal and provincial governments and prepare annual reports demonstrating that the calculations are correct and all salary deductions have been paid. This can be a lot of work for business owners whose time is better spent generating sales and building their businesses. Luckily there are many options for small business owners to calculate their payroll and salary remittances, many of which simplify the process:

19 Features to Consider When Selecting Small Business Accounting Software

A good accounting software can be an invaluable tool for businesses. Before choosing an accounting software it helps to have a detailed understanding of what your accounting system can do for you . This involves analysing the key aspects of your business, determining what is essential (eg. invoicing, expenses, banking, reports) and what you would like to have (eg. time tracking, credit card payments, banking downloads etc.). By reviewing your requirements in advance and building a checklist, you can make a better decision about something that goes to the very foundation of your business. Below are some important features to consider:

How To Close Your Year End (or Period End)in QBO

Doing your own accounting in accounting software such as QuickBooks Online (QBO) is relatively straightforward especially if you have set up your QBO file optimally. You periodically enter invoices, expenses, bills and allocate transactions from the banking download. And while QBO is designed for non accountants, it is also equally appreciated by many accountants for its simplicity and user friendliness (although, as with any software product, there are grievances).

There does come a point, however, when you might notice that some things don’t look right. The bank balance or credit card balance might not match to the QuickBooks balance or your income and/or expenses might seem much too high or inconsistent with previous years. The solution to identifying and fixing these discrepancies is to perform what accountants refer to as year end (or month end) closing procedures, that if done properly, should correct any discrepancies that crop up. The ultimate goal of closing the books monthly or annually is to ensure that you can rely on the integrity of your data.

Why a Separate Bank Account is Essential for Your Small Business

If you are self employed or a small business owner taking care of your own accounting and business finances, you have probably discovered that this can be time consuming and occasionally frustrating. It can sometimes be difficult to know if you are doing things correctly. Consequently, you procrastinate, which makes things worse at year end or tax time. To combat the problem it is important to have tools in place to facilitate the process and make it less painful, which could include accounting software and/or a bookkeeper as well as a good organization system for your documents, whether you have a paperless office or a manual filing system. Another very simple measure that you can take is to have a separate bank and credit card account for your business.

10 Year End Financial and Tax Tips for Your Small Business

As the end of the year approaches, some of us find ourselves overwhelmed by top 10 lists, the shopping masses and endless renditions of Christmas Music. Businesses tend to experience a slowdown, which makes it the perfect time for small business owners to take a closer look at their overall business, financial and tax situation. When you are not buying gifts for your customers, family and friends, a review and analysis of your business will allow you to optimize your current financial situation, implement some beneficial changes that can help avoid last minute tax preparation stress and also prepare for the future.

9 Tips for Building a Sales Forecast

Having a dynamic, regularly updated sales forecast can be essential to the success of a small business. By forecasting your sales revenue you are helping to control for its unpredictability, an inherent risk in any business venture, and prepare for the decisions that are essential to your business profitability. Whether your sales are increasing, decreasing or static, it is always better when decisions are made proactively rather than reactively.

Building your small business sales forecast can be as simple as you want it to be and does not require an accounting degree , particularly when your business is in the early and/or startup stages. Below are some tips to help you create your sales forecast:

How to Read a Profit and Loss Statement

Whether you're just starting out or a seasoned business owner, it is imperative to understand the financial health of your business. This can be done via a variety of different types of analyses. In terms of the big picture and overall performance of your business, the reports that are collectively referred to as the financial statements are the most crucial .

The financial statements typically comprise three reports: the balance sheet, profit and loss statement and statement of cash flows.

Some of you might be intimidated by the technical terminology of accounting. But, in reality , the profit and loss statement (also know as the income statement) is actually quite easy to read and understand especially as it relates to your own business.

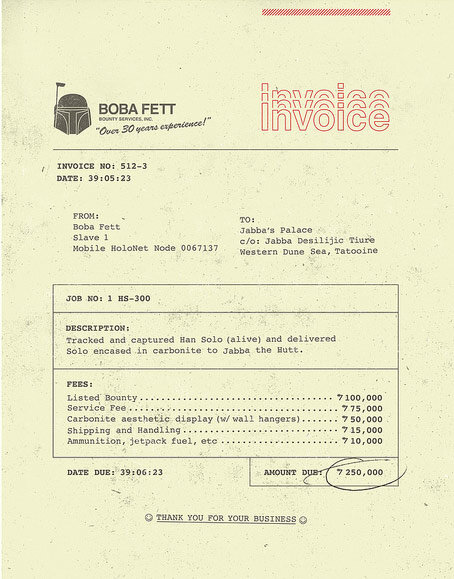

9 Tips For Managing Your Customer Receivables

Any sales that occur within a business where payment is not made up front (eg. retail) or in advance of the sale (eg. down payment for a car), is reflected as an “Accounts Receivable”, which is accounting terminology for amounts owing by customers to a business. It is good to have accounts receivable, as this means you are generating sales. The downside, however, of having accounts receivable is that it represents cash that you don't have now, and along with that comes the possibility that your customers won’t pay you. Luckily a good system to manage your accounts receivable will help to reduce the number of non paying customers thereby avoiding bad debts. Below are some steps to help manage and collect on your accounts receivable:

20 Essential Tax Facts for Small Business/Self Employed Owners

Probably the most popular question posed to accountants and tax preparers (especially around this time of year) is what types of expenses are deductible. The short answer is that an expense is considered to be deductible if it has been incurred with the ultimate purpose of earning income. For example if you purchase a domain name with the intent of setting up a website to sell your goods or services, this would be a deductible expense. However, if the purpose of your website is simply a place to show pictures of your cat, this would not be considered a business and therefore not a deductible expense. Of course if your cat picture website starts to become popular and you decide that you want to actively build this business by advertising on the site or partnering up with cat product resellers, your non commercial hobby could then be considered a business. Since you now have the intent to build a business the income earned would have to be reported and expenses incurred to earn this income would be deductible.

Why and How to Transition from a Sole Proprietorship to a Corporation

When starting your new business, often it makes sense to choose the simplest structure which is the sole proprietorship. This allows you to test the viability of your business idea and to see if the lifestyle and the related stress that goes along with being a business owner suits your personality and is in line with your long term goals. Alternatively, you might want to keep everything simple and not add any unnecessary complexity. Registering and maintaining a sole proprietorship is fairly straightforward ; many business owners don’t put much thought into the financial aspects of it until tax time (when the mad scramble ensues). Once you have a corporation, however, the level of complexity and commitment increases