10 Year End Financial and Tax Tips for Your Small Business

As the end of the year approaches, some of us find ourselves overwhelmed by top 10 lists, the shopping masses and endless renditions of Christmas Music. Businesses tend to experience a slowdown, which makes it the perfect time for small business owners to take a closer look at their overall business, financial and tax situation. When you are not buying gifts for your customers, family and friends, a review and analysis of your business will allow you to optimize your current financial situation, implement some beneficial changes that can help avoid last minute tax preparation stress and also prepare for the future.

9 Tips For Managing Your Customer Receivables

Any sales that occur within a business where payment is not made up front (eg. retail) or in advance of the sale (eg. down payment for a car), is reflected as an “Accounts Receivable”, which is accounting terminology for amounts owing by customers to a business. It is good to have accounts receivable, as this means you are generating sales. The downside, however, of having accounts receivable is that it represents cash that you don't have now, and along with that comes the possibility that your customers won’t pay you. Luckily a good system to manage your accounts receivable will help to reduce the number of non paying customers thereby avoiding bad debts. Below are some steps to help manage and collect on your accounts receivable:

7 Qualities of Highly Desirable Clients

When you are a business owner/freelancer, there is wonderful feeling of gratification when you land a great client. These are clients that ask great questions, respect our work and make us feel happy to have chosen the entrepreneurial route. Then there are the not so great clients who have unrealistic expectations, are unimaginative and often just plain clueless.

It should also go without saying that we must also do what it takes to be provide an excellent experience to our clients and customers. It is not dissimilar from being in a relationship with a partner or spouse and for both sides to get the most out of it, you as the service provider, must also be responsive, respectful, fair and transparent.

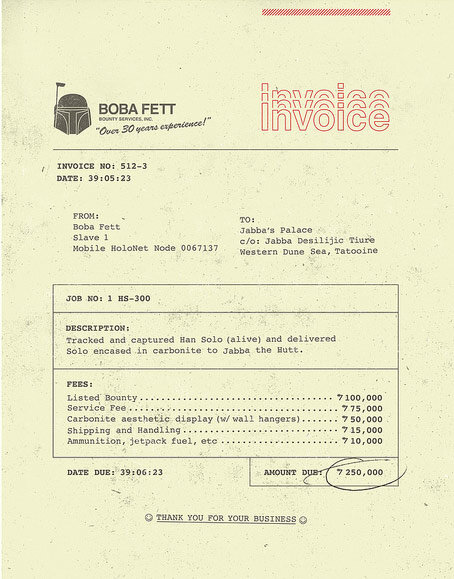

Are Gifts to customers and business associates deductible expenses?

Giving gifts to clients or customers can be a great way to build goodwill, foster customer loyalty and differentiate yourself from your competition. Gifts can be anything from a simple bouquet of flowers to something a bit more personalized based on your knowledge of the customer (it can be useful to listen carefully or probe gently to find out what your customers might want as a thoughtful gift can be tremendously impactful). A gift can be given around the holidays, on birthdays, after closing a sale or any other time as a simple thank you. Of course, if you are buying gifts on behalf of your business, it is important to understand if they qualify as tax deductible expenses and it what circumstances.

Should New Business Owners Register for GST/HST?

The Goods and Services Tax or GST is a consumption tax that is charged on most goods and services sold within Canada, regardless of where your business is located. Subject to certain exceptions, all businesses are required to charge GST , currently at 5%, plus applicable provincial sales taxes. A business effectively acts as an agent for Revenue Canada by collecting the taxes and remitting them on a periodic basis. Businesses are also permitted to claim the taxes paid on expenses incurred that relate to their business activities. These are referred to as Input Tax Credits.

How to Prepare a Business Budget

One of the primary challenges facing a small business owner is uncertainty about the future. (It is also what makes entrepreneurship exciting). We may have an amazing product or service, but we can’t be sure whether this will actually translate into a profitable business model. A budget is an excellent tool to manage uncertainty and, contrary to popular belief, can actually be fairly straightforward to prepare, particularly for small businesses that do not have to worry about different departments, product lines and geographic areas .

A budget, very simply, is a tool that helps you predict your sales, expenses and profitability as well as your cash flow needs. It is based on estimates, which in turn are based on a combination of experience, history and industry knowledge. In terms of presentation, a budget should essentially mirror your financial statements and will include the following main categories:

Employee vs. Self Employed: Criteria and Considerations

For the majority of income earners, employment status is pretty evident. If you are going to the same place every day, have an assigned cubicle with a computer and a corporate stapler, and you have a boss that tells you what you need to do, chances are you are an employee. Conversely if you have several clients, use your own laptop, and are worried about where your next sale is going to come from, you are probably self employed.

There are, however, some workers whose status is not that apparent. For example you may work from home and use your own computer, but you report to one entity, where someone supervises and directs your work. In these cases a determination needs to be made as to whether you are an employee or self employed. It is not enough for the person paying you to determine your classification ; often, payers are biased as they may not want to take on the financial costs and responsibilities of having an employee (explained below). As such, when in doubt about your status, it is helpful to answer the following questions:

Accounting for Non Accountants : Debit, Credits and Financial Statements

When people hear the term accounting, there is an involuntary reaction whereby the comprehension centres (the medical term) of their brains tend to shut down, and sleep mode is activated. This is unfortunate, as accounting, especially to a small business owner, can actually be quite interesting. It is one of the primary tools by which business owners and other interested parties can gage the success of their business, as well as identify areas that require attention andneed improvement. To understand accounting, business owners need to have a basic understanding of how it works (debits and credits) and it's results (financial statements), explained below:

The Many Hats of Self Employment

Being self employed comes with many benefits. You can sleep in, work in your pyjamas and go shopping in the middle of the day. You no longer have to report to a boss who doesn't really understand what you do or deal with mindless workplace politics. It all sounds wonderful, but unfortunately there are also many challenges. Small business owners have to deal with uncertainty and risk. They need to be disciplined and deal with the many demands that being self employed can impose upon us. In the early stages of self employment, most of us have to take on the responsiblity of fulfilling the administrative functions that you find in a more established business. Some of the skills that you need to develop are:

Breaking Up with a (Likeable) Client

Many of us have clients who are annoying, cheap, stupid , high maintenance or some combination thereof. As a new business owner, we are often stuck with these clients because we need them. However, we look forward to the day when we will have the thriving business that we so deserve, and fantasize about the spectacular way in which are going to fire them (you can shove your business into your rear orifice etc.) This is actually a productive fantasy as can help to channel and concentrate anger. Of course, in the majority of cases, a firing should be conducted with slightly less vigour.