Top 6 Signs Your Small Business Might Need a New Accountant

I met with a small business owner recently who had just purchased a retail business and was looking for a new accountant. It seems that the current accountant was reviewing her books on a quarterly basis, preparing financial statements and doing the year-end tax returns – all typical accountant stuff. The problem was that the accountant, while charging this small business a fairly significant amount of money, was not really adding any value to their business. The bookkeeping, which was done by the previous business owner, was still being entered manually in ledgers (!). The quarterly accounting review consisted of checking the ledgers for mathematical accuracy and ensuring no major deductions had been missed without any discussion regarding the performance of the business. Worst of all, the accountant was not responding to the client’s requests for a meeting to discuss the financial performance of the business

There are numerous accountants many of whom are excellent and provide great value. The goal for a business owner is to ensure that you find someone who is a complement to your business. Below are some of the qualities that should be considered when looking for an accountant:

Responsiveness:

Accountants who don’t respond to their clients’ emails and calls on a timely basis is perhaps the most frequent complaint from unsatisfied business owners. The underlying message seems to be that because you are too small, the accountant does not have time for you. Of course, it is important for business owners to keep in mind that accountants, like lawyers, usually charge their clients based on time. If you are emailing your accountant frequently, he or she will have to charge you at some point, depending on the nature of your agreement. That being said, there is rarely a reason to not respond to a clients’ communications.

Adding Value:

The role of accountants has evolved over time. In addition to accounting and tax assistance, small business owners are looking for a professional to provide advice and insight into their businesses. In the example above, it was appalling to learn that their accountant had not encouraged the small business owner to automate his accounting, which would significantly reduce the calculation time and data entry errors (thereby reducing the amount of time the accountant would need to spend). Your accountant should be the first person you consult on financial matters and while she may not always have the answers, she should certainly be able to point you in the right direction.

Technical Competence:

Your accountant, while not necessarily being a specialist, should have a strong understanding of accounting and tax matters. One of my clients had hired an accounting firm to complete her first year corporate tax return. She then found out via an assessment from Revenue Quebec (that charged her taxes, interest and penalties) that they had never been filed. The accountant had never followed up to ensure that it had been done, nor responded to the client when she tried to find out what had happened. They did, however, have the time to send her a sizable bill. Needless to say, she did not pay it.

Erroneous Accounting and Tax Filings:

Several clients have complained of errors in their tax filings and accounting records. One client not only had her birth date entered incorrectly on her tax return (which caused a slew of problems), her address was also wrong resulting in assessments being sent to the wrong address. It took months to resolve. Of course, accountants are not perfect and mistakes are made. What is important is that errors are followed up and resolved quickly.

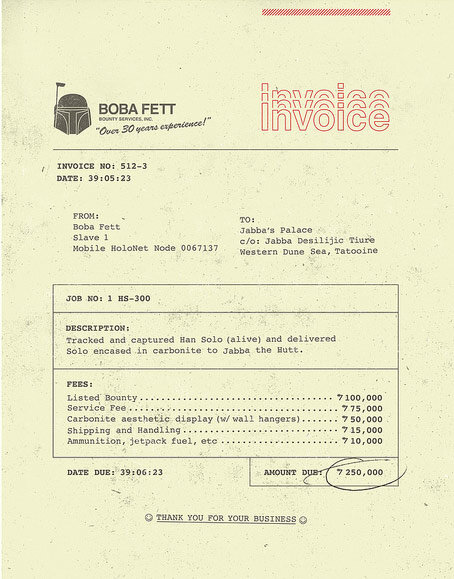

Unexpectedly Large Bills:

I have heard many horror stories by disgruntled clients about the size of their accountant bills. It is important that you and your accountant discuss billing rates and practices in advance so that there are no surprises. Clients often do not anticipate the amount of time it takes to complete certain tasks or research financial and tax matters, which is often the result of the accountant not setting the proper expectations.

Explaining Technical Concepts:

Many small business owners have told me that their accountants are not very good at explaining financial concepts or tax requirements. While many of these concepts are somewhat technical, small business owner are usually able to grasp at least the gist of them as it so closely relates to their businesses. It is important that your accountant never make you feel stupid.

Choosing the right accountant doesn’t have to be difficult. Ideally you want someone who is the right fit, and with whom you feel comfortable discussing the various financial aspects of your small business. They should be involved with more than just your annual tax filings and should feel like a partner to your business rather than an outsider.

Ronika Khanna is a Montreal accountant who helps small businesses achieve their financial goals. To receive regular updates of articles pertaining to small business, accounting, tax and other topics of interest to business owners you can sign up here. You can also follow her on Linkedin.