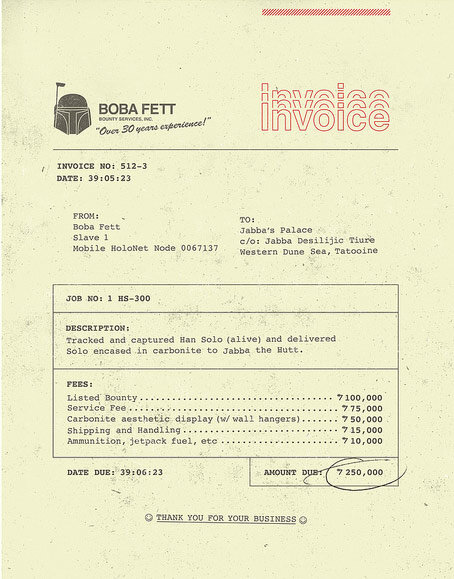

9 Tips For Managing Your Customer Receivables

Any sales that occur within a business where payment is not made up front (eg. retail) or in advance of the sale (eg. down payment for a car), is reflected as an “Accounts Receivable”, which is accounting terminology for amounts owing by customers to a business. It is good to have accounts receivable, as this means you are generating sales. The downside, however, of having accounts receivable is that it represents cash that you don't have now, and along with that comes the possibility that your customers won’t pay you. Luckily a good system to manage your accounts receivable will help to reduce the number of non paying customers thereby avoiding bad debts. Below are some steps to help manage and collect on your accounts receivable:

10 Financial Challenges of Being a Solopreneur

Being a solo entrepreneur or solopreneur (to use the pithier term) can be extremely rewarding but also brings some unique challenges. It can be a lonely existence, as you often work from home, and don’t have a water cooler where you can discuss the latest tv show you are watching. You have to become an expert on subject matters well outside of your subject of expertise, as all of us who have to troubleshoot a computer problem or write our own copy for social media and blogs, can attest to. There is no-one immediately availably to bounce ideas off of. And we have to work much harder at establishing process, routines and accountability since we don’t have a boss breathing down our necks.

In addition to all of this, solopreneurs often face specific accounting, tax, and finance challenges.

20 Essential Tax Facts for Small Business/Self Employed Owners

Probably the most popular question posed to accountants and tax preparers (especially around this time of year) is what types of expenses are deductible. The short answer is that an expense is considered to be deductible if it has been incurred with the ultimate purpose of earning income. For example if you purchase a domain name with the intent of setting up a website to sell your goods or services, this would be a deductible expense. However, if the purpose of your website is simply a place to show pictures of your cat, this would not be considered a business and therefore not a deductible expense. Of course if your cat picture website starts to become popular and you decide that you want to actively build this business by advertising on the site or partnering up with cat product resellers, your non commercial hobby could then be considered a business. Since you now have the intent to build a business the income earned would have to be reported and expenses incurred to earn this income would be deductible.

How to Register your Sole Proprietorship in Each Province

Once you have decided to start a new business and have concluded that the best structure for your business is a Sole Proprietorship, the next step is to determine if you need to register it. If you are using your exact first and last name, and only your exact first and last name, then you are not required to register your business, regardless of which province your are located in. However, if you are using a business name that is anything other than your own name, you are required to register your business in all provinces, with the exception of Newfoundland and Labrador where registration of Sole Proprietorships is not required.

7 Qualities of Highly Desirable Clients

When you are a business owner/freelancer, there is wonderful feeling of gratification when you land a great client. These are clients that ask great questions, respect our work and make us feel happy to have chosen the entrepreneurial route. Then there are the not so great clients who have unrealistic expectations, are unimaginative and often just plain clueless.

It should also go without saying that we must also do what it takes to be provide an excellent experience to our clients and customers. It is not dissimilar from being in a relationship with a partner or spouse and for both sides to get the most out of it, you as the service provider, must also be responsive, respectful, fair and transparent.

Tax Obligations Every Canadian Small Business Should Know

It is therefore prudent for both sole proprietorships and incorporated businesses to keep on top of their tax filings.

In this article I enumerate the tax obligations for most small businesses in Canada along with links to articles to help you understand each one better.

Adopt These 9 Money Habits to Increase Your Net Worth

One way to reinforce habits is to celebrate small wins. If you eat slightly less junk food or exercise a bit more, you can count it as an accomplishment. The positive reinforcement helps to make us feel better, inspire confidence and slowly build habits that makes reaching our goals a bit easier. This is particularly true with financial discipline. It is important to recognize that, like any habit, it is a process that takes time. The good news is that there are tangible metrics to measure your success e.g. when you have more in your investment accounts or a higher net worth.

Essential Facts about Shareholder Loans for Incorporated Small Business Owners

There are three primary ways in which you, as an owner-manager, can withdraw funds from your corporation. You can pay yourself a salary, you can declare a dividend or you can borrow money from the corporation. When you borrow money from your own corporation the Canada Revenue Agency (CRA) has put into place strict rules as to when you have to repay the loan to ensure that the owner-manager does not avoid paying taxes indefinitely.

How to Register a Small Business in Quebec

Budding entrepreneurs wanting to setting up a small business (or becoming self employed), either on a full time or part time basis, are often not sure where to start. The process of registering a business in Quebec, depending on your circumstances, can actually be quite straightforward . Below we look at the questions that you need answer to determine your business registration obligations:

Why and How to Transition from a Sole Proprietorship to a Corporation

When starting your new business, often it makes sense to choose the simplest structure which is the sole proprietorship. This allows you to test the viability of your business idea and to see if the lifestyle and the related stress that goes along with being a business owner suits your personality and is in line with your long term goals. Alternatively, you might want to keep everything simple and not add any unnecessary complexity. Registering and maintaining a sole proprietorship is fairly straightforward ; many business owners don’t put much thought into the financial aspects of it until tax time (when the mad scramble ensues). Once you have a corporation, however, the level of complexity and commitment increases

How To Account for Car Expenses and Reflect Personal Use

If you use your car for business then you will want to track car expenses more granularly to see what you have spent in the current period and to compare with prior periods and also to make it easier to reflect the breakdown on your small business taxes

Deferred Revenue and its Impact on your Small Business

Most small business owners are familiar with the concept of revenues, which is essentially the total sales of their product or service, to customers and clients, prior to deducting any costs. Revenues are a crucial component of business’ profit and loss statement and it is essential that they are accurate so that the business owners may effectively analyze the profitability of their businesses. Additionally there are third parties for which the accuracy of the revenues, and corresponding financial statements, is essential for effective decision making. Third parties include tax authorities, banks, partners and key employees (on which remuneration/bonuses might be based).

What Types of Advertising/Marketing Expenses Can Small Businesses Deduct?

In the past advertising for small business owners mostly involved ads for print, television or radio (a catchy jingle was always a good way to go), cold calling (rarely a pleasant experience), sending out flyers or courting potential customers at a conference. Unfortunately, these types of advertising were problematic in that it is difficult to gage the direct impact of their effectiveness. Additionally, they were often fairly costly, which can especially difficult for small business owners to afford.

Over the past few years the avenues for advertising have grown exponentially. Many types of advertising don’t even cost anything, except time. You can buy ads on numerous social media outlets that appeal to your target market or if you want to go the free route, you can set up a social media account, post regularly and build an audience. Alternatively, you can set up a website which you can then optimize so that google and other search engines display it when someone is looking for your product or service. Email newsletters are also another effective and direct way of reaching potential buyers. One of the great benefits of these types of advertising is that you are better able to monitor the effectiveness of your chosen strategy.

Frequently Asked Questions About Salary and Dividends by Owners of Corporations

As an accountant and small business financial consultant, one of the most common areas of confusion and questions by small business corporation owners revolves around how to pay themselves and if one way is preferable to another. I have addressed some of them in my blog posts on the factors to consider when choosing salary or dividends and the types of ways to structure your remuneration . There are however specific questions that common up frequently: