What is Capital Cost Allowance and How Does it Impact Your Business

Frequently a client of mine will purchase a high ticket item such as a computer or a piece of furniture and will simply show it as an expense on their profit and loss. As far as they are concerned, if you spend money on acquiring something you should be able to write it off against your income. This makes logical sense from a certain point of view. Unfortunately, accountants and revenue agencies do not see it this way. From their perspective, an item that is purchased for a business, whose value extends beyond one year, is actually an asset that should be depreciated over the useful life of the asset. In other words, the expense that you can claim for the asset is only the portion of the asset that is used in the year that you claim it. While there are different accounting methods to reflect depreciation, Revenue Canada requires that you apply a percentage depending on the “class” in the asset is classified and is referred to as capital cost allowance or CCA.

What Types of Car Expenses Can Business Owners Deduct

Access to a car can be crucial to running a small business effectively. Costs of ownership, however, can be high relative to your revenues, especially in the early stages when your business is not hugely profitable. Luckily, Revenue Canada (CRA) and Revenue Quebec (RQ) allow both unincorporated/self employed individuals and owners/employees of corporations, who use their cars to generate income, to deduct the relevant expenses. Both CRA and RQ provide detailed guidance and have specific rules relating to the write off of car expenses. I discuss some of the main provisions that impact small business owners in this article and provide guidance on the differences between unincorporated (self employed/small business) owners and corporations.

4 Accounting Transactions that Use Journal Entries and How to Enter them in QBO

Accounting software has come a long way in the past few years. Although a good bookkeeper can be invaluable, It has become fairly easy for business owners and their support staff to take on the responsibility of entering day to day transactions while they employ accountants for the more complex aspects of their accounting and tax. While entering the majority of transactions in software, such as Quickbooks Online is fairly straightforward, there are transactions that require somewhat special treatment discussed below:

How to Calculate Your Automobile Taxable Benefits for the Purposes of the T4 and Rl1

The majority of businesses require the use of cars and other types of vehicles to meet with clients, and suppliers, purchase goods, make service calls and of course check in with their accountants. The usage of a car is not necessarily straightforward as many employees and business owners use their vehicles for both business and personal reasons. As such, Revenue Canada has had to implement tax legislation that ensures that the personal portion of automobile usage is properly adjusted and excluded from deductible businesses expenses.

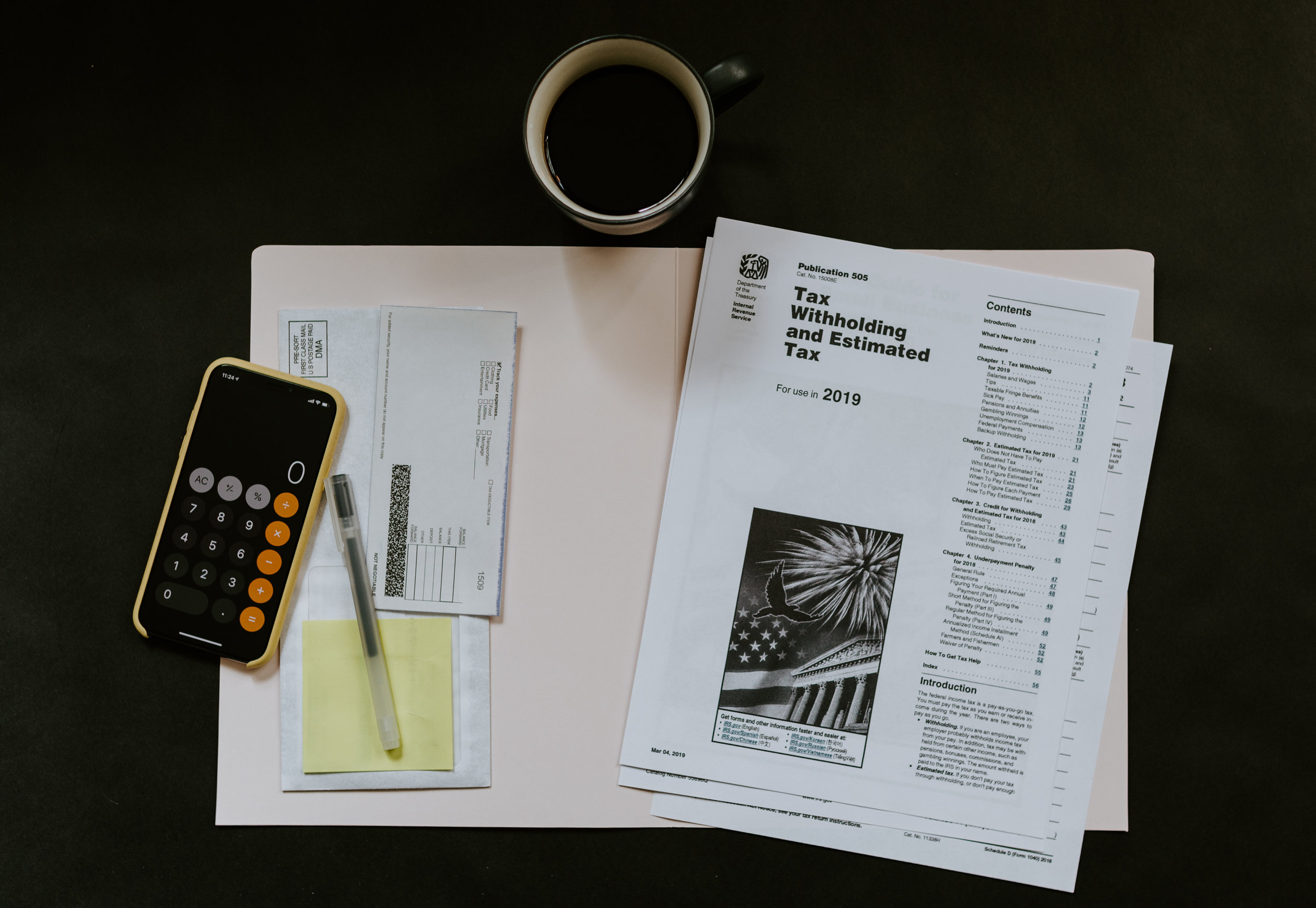

How to Change Your Personal Tax Return After It Has Been Filed

Revenue Canada recommends that you should wait to receive your notice of assessment (NOA) before filing an amended return. Once you receive your NOA, you should review it to verify if the error or omission has been reflected on the assessment. If not, then you would proceed with submitting the amendment. Luckily, you are not required to redo your entire return; rather you just need to submit details regarding the specific changes. There are several ways in which you can file an amended return.

What is a notice of assessment and How to Handle a request for information

After you file your income tax return Revenue Canada (CRA) and Revenue Quebec (RQ) will send you an acknowledgement (somewhat like a report card) that the return has been received and a detailed breakdown of the tax return that was filed including any discrepancies. It also provides some information pertaining to future years such as limits and carryforwards. The NOA is also referred to as an “avis de cotisation” if your preferred language is French or when you receive one from RQ. Some of the information that can be found on a notice of assessment includes:

How to Use Online Banking to File and Pay Your Business Sales Tax, Payroll DAS and Corporate Tax

The major Canadian banks including RBC,CIBC, TD, BMO and Scotiabank as well as some regional banks such Caisse Desjardins Access D’Affaires conveniently have business tax filings service which replicate the forms that have to be submitted to the government for:

sales tax (GST/HST and QST),

Payroll tax (deductions at source payable to Revenue Canada and Revenue Quebec) and

corporate taxes payable to Revenue Canada (CRA) and Revenue Quebec (RQ).

Business tax instalment payments (including GST-QST instalments)

This means that instead of entering the data on the forms that are available via my business account at CRA and RQ and then going to your bank to make payment, either online or via mail, it can all be done at one time through one form that serves as both tax filing and payment.

Should you use accounting software or a spreadsheet to track your small business finances?

Over the years my clients have come to me with their financial data in various formats. I have received shoeboxes of receipts which need to be deciphered and compiled. Some clients have given me their spreadsheets in excel, google or occasionally summaries in a word document. Others decided it made sense to use accounting software right at the outset of their businesses.

In many cases, using a spreadsheet is perfectly fine and sufficient for small business or self employed individuals where you simply need a way to determine your income and expenses. There are situations, especially when you are planning to do your own small business accounting, where it can be significantly beneficial to upgrade your record keeping from a spreadsheet to accounting software. I have enumerated some of the factors to consider when determining if your spreadsheet is enough for your accounting needs or whether it is time to upgrade.

Are Gifts to customers and business associates deductible expenses?

Giving gifts to clients or customers can be a great way to build goodwill, foster customer loyalty and differentiate yourself from your competition. Gifts can be anything from a simple bouquet of flowers to something a bit more personalized based on your knowledge of the customer (it can be useful to listen carefully or probe gently to find out what your customers might want as a thoughtful gift can be tremendously impactful). A gift can be given around the holidays, on birthdays, after closing a sale or any other time as a simple thank you. Of course, if you are buying gifts on behalf of your business, it is important to understand if they qualify as tax deductible expenses and it what circumstances.

A Guide To Preparing the T2125 For Small Business Or Self Employed Owners

While being self employed comes with numerous benefits, there are also many challenges. One of the major ones is ensuring that you are aware of, and fulfill, your tax obligations on a timely basis. In the beginning these tax obligations can seem mystifying and somewhat overwhelming, but once you understand what needs to be done and you set up processes and reminders, it tends to become much more manageable. This in turn reduces stress as tax deadlines approach and can result in significant potential tax savings as you keep track of all your tax deductions and avoid interest and penalties.

How to Reflect Investment Income and Capital Gains/Losses on your Personal Tax Return

Residents of Canada are required to reflect all sources of worldwide income on their personal tax returns. For most individuals, who have investments with Canadian based banks and brokerages, this is fairly straightforward as you will receive the relevant tax slips, usually by March 31st of the year following the end of the calendar year i.e. for the 2023 tax year, you should receive all investment related tax forms and slips by March 31st, 2024. It is important, if you have investment income in non registered investments (i.e. not TFSA, RRSPs or FHSAs), to ensure that you have received all tax documents and report them. Failure to report income can result in penalties by Revenue Canada and Revenue Quebec, which is never great, particularly when it can be easily avoided. It should be noted that since most tax documentation is submitted by the issuer to Revenue Canada (CRA) and Revenue Quebec (RQ) electronically, they usually have a record of the various types of investment income for each taxpayer and can easily identify any missing information.

Should New Business Owners Register for GST/HST?

The Goods and Services Tax or GST is a consumption tax that is charged on most goods and services sold within Canada, regardless of where your business is located. Subject to certain exceptions, all businesses are required to charge GST , currently at 5%, plus applicable provincial sales taxes. A business effectively acts as an agent for Revenue Canada by collecting the taxes and remitting them on a periodic basis. Businesses are also permitted to claim the taxes paid on expenses incurred that relate to their business activities. These are referred to as Input Tax Credits.

Make Your Taxes Easier with this Detailed Checklist

The deadline to file tax returns is quickly approaching, resulting in various degrees anxiety for some taxpayers and accountants. The good news is that the stress can be managed fairly easily with some simple organization techniques. The most effective starting point is to evaluate your tax situation and prepare a checklist of the documentation that you will need with respect to your specific tax situation. A checklist can help to ensure that important items are not overlooked in the rush to put everything together (and, of course, its always satisfying to cross something off the list).

Do you have to charge QST if your business is located outside of Quebec?

Quebec is unique in a number of different ways. This is great if you enjoy exposure to different types of culture and cuisine. It isn’t so great where it comes to tax. Almost every type of tax filing in Quebec requires an additional return, which often has different rules and calculations from the federal tax filings. Quebeckers are resigned to this and fortunately tax software or a good accountant tends to make the management of taxes significantly easier.

Prior to January 1st, 2019 a business, even if they had customers in Quebec, did not have to worry about Quebec based taxes as long as they did not have a physical or significant presence in Quebec. This changed on January 1st, 2019 when Quebec implemented a comprehensive set of rules for businesses located outside of Quebec, that, if they meet certain criteria, are now required to collect and report Quebec Sales Tax (QST or TVQ) on sales made in Quebec.