How to Change Your Personal Tax Return After It Has Been Filed

Table of Contents

Despite your (and/or your accountants’)best efforts , occasional errors or omissions relating to your personal tax return are unavoidable. It is possible that you forgot to include a tax slip, overstated your expenses or was unaware of a specific tax credit. Luckily there is fairly simple mechanism that allows you to change your tax return, which can either be done online or by filling out a form and mailing it in.

Examples where an amended return might be required:

You forgot to include a tax slip e.g. A T4A or a T5 which was either received after you filed your tax return or was left in a pile that did not make it into your tax return documentation. Often missing slips are caught by Revenue Canada (CRA) , so it is important to wait for your notice of assessment before filing an amendment.

If you are a small business owner, you may have omitted or misstated some revenues or expenses, your calculations for home office expenses or car expenses that you can deduct may be incorrect or perhaps you forgot to include assets that can be depreciated eg. computers

You might only realize after you have submitted your tax return that you are entitled to a tax credit eg. the new home buyer’s credit or the hybrid car tax credit.

Your RRSP contributions are incorrect or missing.

Education or tuition tax credits have not been included, which is a fairly common mistake, since often students don’t file their tax returns as they don’t believe there is any benefit. However, as a student, even if you only have a tuition tax slip it is beneficial to file your tax return as the tuition tax credits can be applied against future income (thereby reducing taxes). Also, students may be eligible for certain tax credits like the GST credit and the solidarity tax credit in Quebec. Note that the tuition credits have to be included in the tax year to which they relate and not on a future tax return.

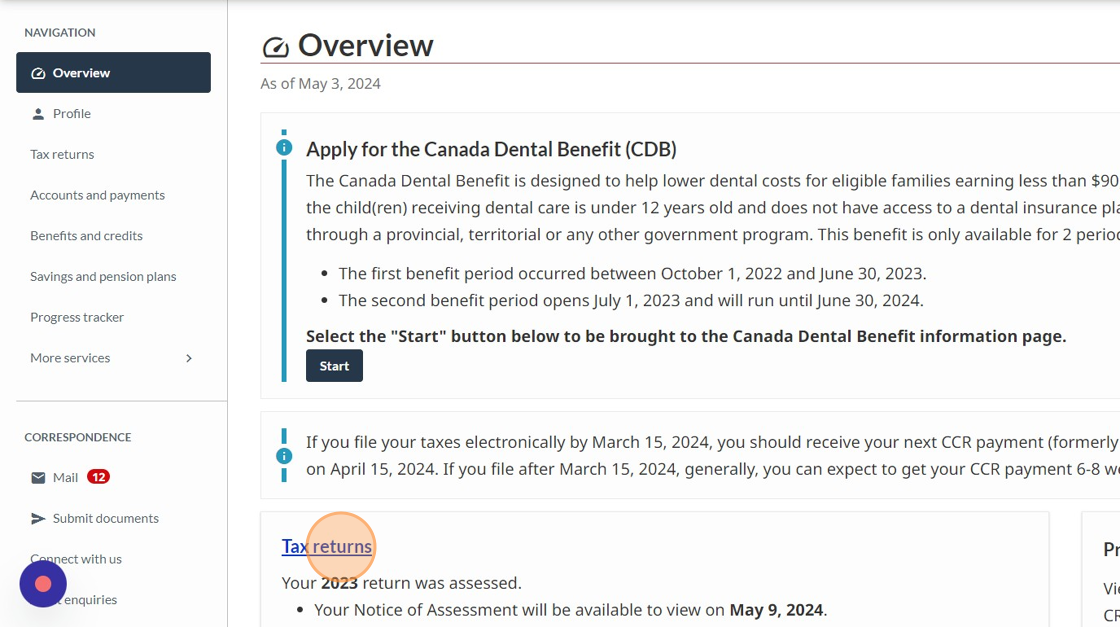

In some cases Revenue Canada (or Quebec) will make the adjustment automatically based on information that they already have (e.g. data from T4 and T5 slips) and will reflect it on your notice of assessment. It is a good idea to save it since there are several occasions on which you may need it. If you have signed up for CRA My account , then the assessments should be available in the online portal.

How to file an amended return with Revenue Canada:

Revenue Canada recommends that you should wait to receive your notice of assessment (NOA) before filing an amended return. Once you receive your NOA, you should review it to verify if the error or omission has been reflected on the assessment. If not, then you would proceed with submitting the amendment. Luckily, you are not required to redo your entire return; rather you just need to submit details regarding the specific changes. There are several ways in which you can file an amended return.

How to Sign Up for CRA My Account

Revenue Canada allows you to submit changes electronically. This process can be initiated on the CRA “my account” section of their website which actually gives you access to all of your personal tax information and is certainly worth signing up for. You will need the following information to register:

your social insurance number;

your date of birth;

your current postal code or ZIP code and;

an amount you entered on your income tax and benefit return, so have a copy of either your personal tax return or latest notice of assessment on hand (the line requested will vary and it could be from either the current tax year or the previous one).

Once you have registered, you usually have to wait to receive a security code or in some cases you can request this by phone.

After the security code has been received, you can log in to your account.

Submit Changes to your Tax Return Using CRA My Account:

Step 1: Login to CRA My Account and click on Tax Returns:

Step 2. Click on “Change My Return” on Right Hand Side

Step 3. Ensure that you don’t have changes that are ineligible by reviewing the “ineligible changes”. These include:

a tax return that has not been assessed

a tax return where 9 reassessments exist for a particular tax year

a bankruptcy return

a return prior to the year of bankruptcy

certain returns for international or non-resident clients, including returns for sojourners, returns filed under section 116, 216, or 217, or an Old Age Security Return of Income (OASRI)

a return where you have income from a business with a permanent establishment outside your province or territory of residence (you have to complete Form T2203, Provincial and Territorial Taxes for Multiple Jurisdictions)

a return that was filed by the CRA under subsection 152(7)

Step 4. If none of the above apply to you, then you can go ahead and make changes to the specific line items on the return or add additional tax slips. You can also add additional information.

Step 5: Once you have entered the information to be changed, review your changes and if all looks good, then click on submit.

You are allowed to change your income tax return for the current as well as the prior NINE taxation years.

Submit Changes by Mail using the T1 Adjustment form

If you don’t have access to the online service or you would rather just submit the changes manually, you can either fill out the T1 Adjustment Request or you can also simply submit a letter providing details of the change along with your personal and contact details. You should also submit supporting documentation at this time to avoid a complicated back and forth exchange with CRA. Keep in mind that it takes significantly longer to process a request received via mail then online. Once the change is processed you will receive a notice of reassessment and details on whether the amendment was accepted that will be posted in CRA My Account.

Mail the return to your tax centre.

Use your Tax Software to Change Your Tax Return

If you used tax software to prepare the return for which you are requesting an amendment, you can usually access the adjustment form there and use the Refile function. Each tax software is a bit different however you should be able to find the refile or change your tax return functionality by doing a search in their help section. Once you find the form, the software will prompt you for the details that need to be entered after which you might be able to submit it electronically or alternatively print and sign the form and mail as indicated in the section above.

Amend/Change a return with Revenue Quebec

The process for changing or amending your return is very similar with Revenue Quebec. You can either do it online using the Revenue Quebec’s my account or you can fill out the Request for an Adjustment to an Income Tax Return (form TP-1.R-V) and mail it in.

For details on how to change the return with Revenue Quebec you can refer to their section on correcting an error or omission.

If you are using UFile to prepare your tax return, the form can be created at the interview setup where you would select “Adjustment request for a tax return that has already been filed”. Scroll down to “Adjustment Request “to locate the data section for both Revenue Canada and Revenue Quebec.

Voluntary Disclosure Program

Any adjustments that result in an increase in your taxes payable could lead to penalties, which, depending on the amounts and the time period that has elapsed, can be significant. To encourage taxpayers to come forward with any potential omissions or errors that result in higher taxes, the CRA and Revenue Quebec have a voluntary disclosure program which, if certain conditions are adhered to, may waive these penalties and potential prosecution. Details can be found at the links below:

Revenue Canada Voluntary Disclosure Program

Revenue Quebec Voluntary Disclosure Program

Although, amending a return is never fun it can be relatively painless especially if the changes are minor. For more significant changes that you have some doubt about, I do always recommend contacting an accounting or tax preparer to help you with the process. It is best to get it done as soon as possible after you have discovered the error (and received your notice of assessment) to avoid having CRA or RQ discover it thereby creating problems, penalties and potential prosecution.

Interested in improving your financial literacy? Sign up for my newsletter for expert insights on tax, finance, and accounting, designed for solopreneurs and small business owners.