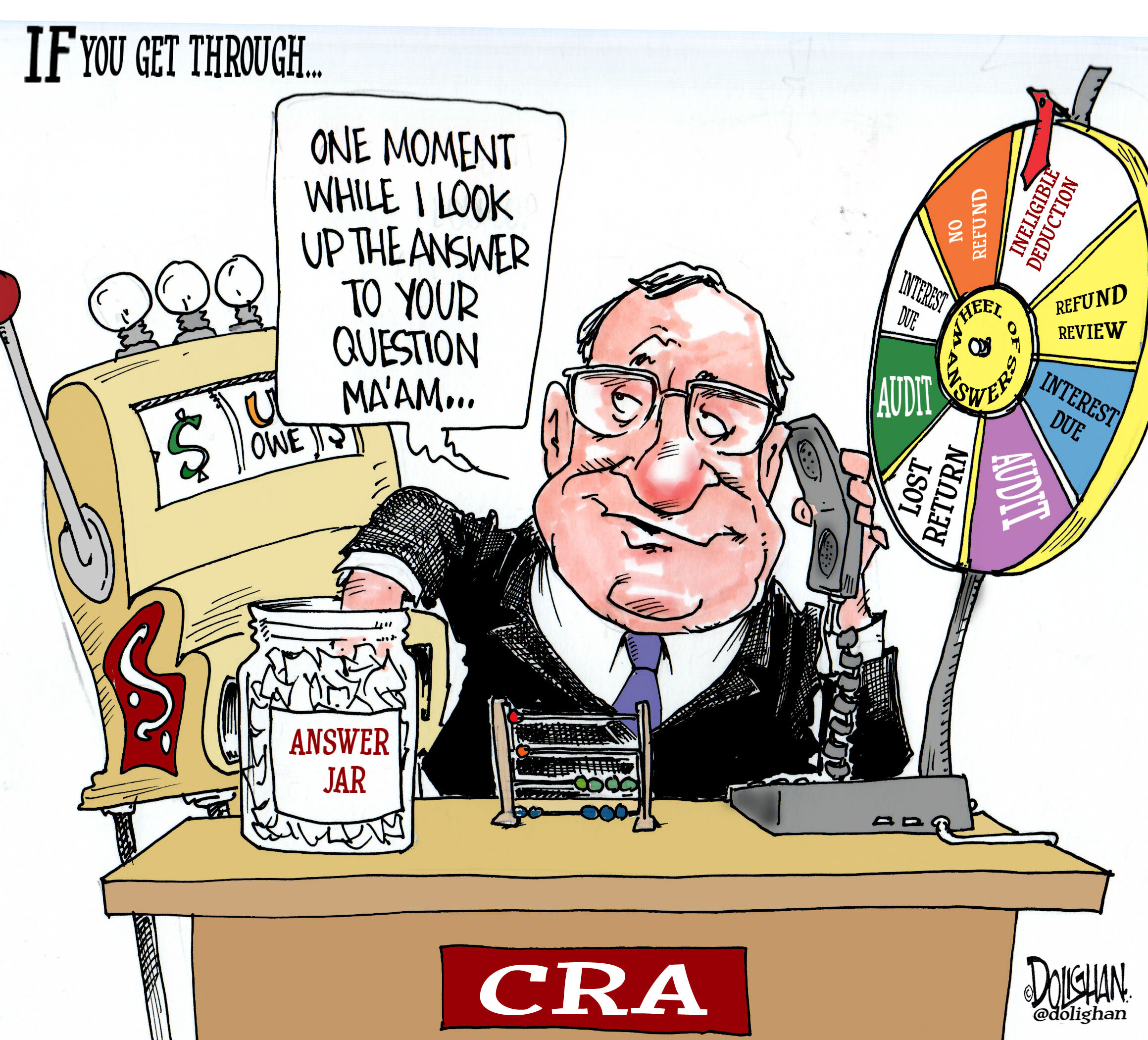

Know Your Small Business Tax Deadlines For 2023

Somehow we are almost one month into 2023 (!) and it is time for business owners (and individuals) to start thinking about one of their favourite subjects i.e. taxes. I have compiled a list of the deadlines that all of you should know and also updated my annual business tax deadline calendar.

Sign up to download our free Canada unincorporated business tax deadline calendar for 2023 or Quebec unincorporated small business tax deadline calendar 2023.

What Independent Contractors Should Know About Personal Service Businesses

Many of you leave your full time jobs to become independent contractors. This could be for a variety of reasons: you might decide you want the freedom that comes with self employment, or your company might decide that they no longer want to maintain employees. In some cases, you are laid off and find another opportunity , but the business only offers contract positions.

This type of situation is particularly applicable to people in the IT industry but can also apply to a variety of other types of skill sets. Often, your client will require that you set up a corporation which then contracts with the client to provide services that are very similar to those you would provide if you were an employee. The corporation then bills your client either directly or through a third-party (often a recruiting agency).

Information on Filing T4s/RL-1s and T4As for Small Business Owners

When I was employee, I never really gave much thought to the T4 (and the Quebec equivalent RL-1) process. I knew that sometime around February an envelope would appear on my desk with a tax document which I would need to reflect on my tax return. I suppose I thought that someone, somewhere pressed a button and the T4s were generated. When I became a small business accountant, who was now either responsible for preparing this information or providing guidance to my clients, I realized that the process was somewhat more complicated.

Know Your Small Business Tax Deadlines For 2022

With the beginning of a new year upon us, tax submission deadlines for individuals and businesses are starting to loom. Every small business owner must adhere to these deadlines or risk facing penalties for late filing of returns plus interest on any overdue balances. Knowing these deadlines can help you ensure that you don’t simply waste your hard earned money and run afoul of CRA and RQ. I have compiled a list of deadlines for all unincorporated small business owners which includes sole proprietors and self employed individuals.

Note that the usual deadline for sales tax (GST/HST and QST) payments and income tax returns is April 30th. However, since this falls on a Saturday, the deadline is pushed to Monday, May 2nd, 2022.

What Are Bank Reconciliations and Why Every Business Should Do Them

Many small business and self employed owners take on the responsibility of doing their own accounting. You may do all of your own accounting from set up to preparing your own small business tax return OR you may have an accountant who simply takes care of your year end and tax reporting. Accounting software has made doing your own accounting much simpler and allows for most business owners to do it, regardless of whether they have some sort of accounting background. There is however a learning curve and certain accounting steps that not everyone is aware of and that are very important to ensure the accuracy of your books. One of these is are bank reconciliations.

3 Tools that allow you to Remotely Connect to your Computer from Anywhere

The past few years, and especially the last year has changed the way many business owners and employees work. There has been a mass adoption of virtual workspaces where people are no longer tethered to their offices. Instead the technology to make working from anywhere has increased and improved significantly and is accessible by anyone who has a working internet connection. Business can be conducted from your home, an airport, a café or (if you are lucky) on the beach.

While many software, apps and programs are available in the cloud and can directly be accessed directly from your computer or smartphone internet browser, there are times when you need access to your actual desktop or another computer so that you can access the programs and data files that reside there. Luckily, there are numerous tools out there that allow small business owners to remotely connect to their computers . Three of these are discussed below:

8 Inexpensive Ways to Market Your Services

One of the most daunting aspects of starting a new small service based business is building a client base (and nothing is quite so exciting as getting those first few clients). When trying to generate new business, it is important to cast a wide net as you never know where potential clients may be lurking. Once you have established your business, you will discover the methods that work best for you and you can finesse your marketing strategy. You can also choose to be more selective as you determine which type of client is the best fit for your business.

There are many ways to build a client base, even with limited resources, some of which are discussed below:

Tax Return Checklist for Individuals and Unincorporated Business Owners

The deadline to file tax returns is starting to loom large, resulting in anxiety for some individuals and small business owners. The good news is that the stress can be managed fairly easily with some simple organization techniques. The best starting point is to evaluate your tax situation and prepare a checklist of all the documentation that you will need with respect to your specific tax situation. A checklist can help reduce (or eliminate) important items that might get forgotten in the rush to put everything together (and its always satisfying to cross something off the list). I have compiled a list of some of the more common income, deductions and credits that the majority of taxpayers are likely to have:

9 Year End Tax Planning Tips for Small Business Owners

For numerous people around the world, the end of this year cannot come soon enough. It has been an unprecedented few months, the effects of which will be felt for many years to come. And while it has been extremely difficult for some small business owners such as restaurants and storefront retail, others have seen their businesses flourish. e.g. toilet paper manufacturers, Amazon and Zoom. Many businesses were able to pivot their business models to provide goods and services that cater to the “new normal” in interesting and creative ways. Some started selling masks while others increased their online course offerings. Beleaguered restaurants started expanding their delivery menus and offerings. To a dispassionate business analyst, this year has been somewhat fascinating and will provide a great deal of data to economists and analysts alike in the years to come.

It is time for business owners everywhere to start contemplating some end of year tax planning tips to not only ensure that they can maximize their tax deductions and reduce taxes payable, but to streamline the tax filing process in the New Year. Even if you are incorporated and your year end date is not December 31st, it is a good time to take advantage of calendar year deadlines for personal tax planning purposes.

4 Simple Financial Metrics to Help Measure the Success of Your Small Business

Most small business owners want insights into their business performance to get a sense of what they are doing well while also trying to understand their areas of weakness. Unfortunately a big picture view does not always immediately reveal itself– a thorough understanding of your business generally requires a more thorough analysis and introspection. You may be tempted to look at cash (or lack thereof) in your bank account or your net profit , however these are not always reliable indicators of success or failure , particularly when taken in isolation. Every small business owner should identify the specific needs and constraints of their business to determine the optimal analysis required to assess its financial performance. Some general analysis that most businesses can benefit from are presented below:

Top 6 Signs Your Small Business Might Need a New Accountant

I met with a small business owner recently who had just purchased a retail business and was looking for a new accountant. It seems that the current accountant was reviewing her books on a quarterly basis, preparing financial statements and doing the year-end tax returns – all typical accountant stuff. The problem was that the accountant, while charging this small business a fairly significant amount of money, was not really adding any value to their business. The bookkeeping, which was done by the previous business owner, was still being entered manually in ledgers (!). The quarterly accounting review consisted of checking the ledgers for mathematical accuracy and ensuring no major deductions had been missed without any discussion regarding the performance of the business. Worst of all, the accountant was not responding to the client’s requests for a meeting to discuss the financial performance of the business

4 Factors to Consider When Pricing Your Small Business Services

One of the most challenging aspects of starting and maintaining a business, regardless of whether you are a freelancer or a conglomerate, is determining the right price to charge for your services. If you are an economist, the ideal price is simply the point at which demand meets supply. If a price is too high the demand for the service will go down thereby resulting in excess supply or capacity by the service provider. If the price is too low then demand will increasing leaving the supplier less availability to meet demand. Of course, pricing can be significantly more complex than this and has become a lot more sophisticated in recent years. Businesses pay thousands of dollars to pricing consultants for strategies that take numerous factors into consideration when determining pricing. One only has to look to airlines as example of a seemingly inscrutable pricing model. Unfortunately, smaller businesses, freelancers and startups don’t usually have the budget for a pricing strategist and have to make do by searching for information available on the internet, discussing it with their business associates or simply using their gut to come up with something that makes sense. As an internet source, I have set out a strategy for determining a price for your services

Why a Separate Bank Account is Essential for Your Small Business

If you are self employed or a small business owner taking care of your own accounting and business finances, you have probably discovered that this can be time consuming and occasionally frustrating. It can sometimes be difficult to know if you are doing things correctly. Consequently, you procrastinate, which makes things worse at year end or tax time. To combat the problem it is important to have tools in place to facilitate the process and make it less painful, which could include accounting software and/or a bookkeeper as well as a good organization system for your documents, whether you have a paperless office or a manual filing system. Another very simple measure that you can take is to have a separate bank and credit card account for your business.

19 Features to Consider When Selecting Small Business Accounting Software

A good accounting software can be an invaluable tool for businesses. Before choosing an accounting software it helps to have a detailed understanding of what your accounting system can do for you . This involves analysing the key aspects of your business, determining what is essential (eg. invoicing, expenses, banking, reports) and what you would like to have (eg. time tracking, credit card payments, banking downloads etc.). By reviewing your requirements in advance and building a checklist, you can make a better decision about something that goes to the very foundation of your business. Below are some important features to consider:

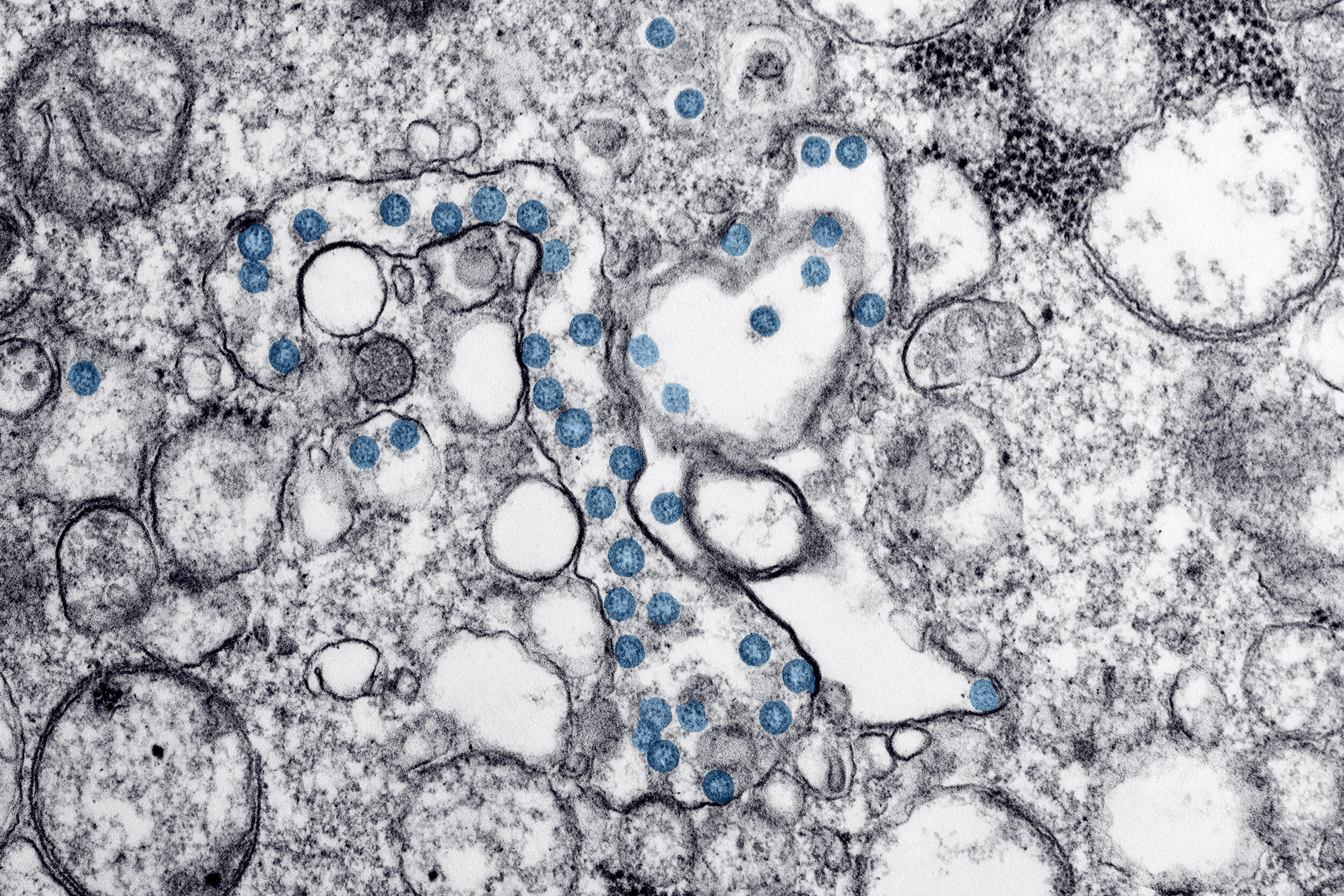

COVID-19: Financial and Tax Relief Measures for Small Business and Individuals (UPDATED)

UPDATED APRIL 27, 2020

In response to the financial pressure being felt by small business, employees and individuals as a result of COVID-19, a number of measures have been announced by governments and banks to alleviate this difficulty These are enumerated in this post and while details relating to eligibility, how to apply etc. on the measures announced by the federal government today are still forthcoming, small businesses and individuals now know what types of financial relief they may be eligible for and can start preparing accordingly.