RRSP Facts and Figures: Infographic

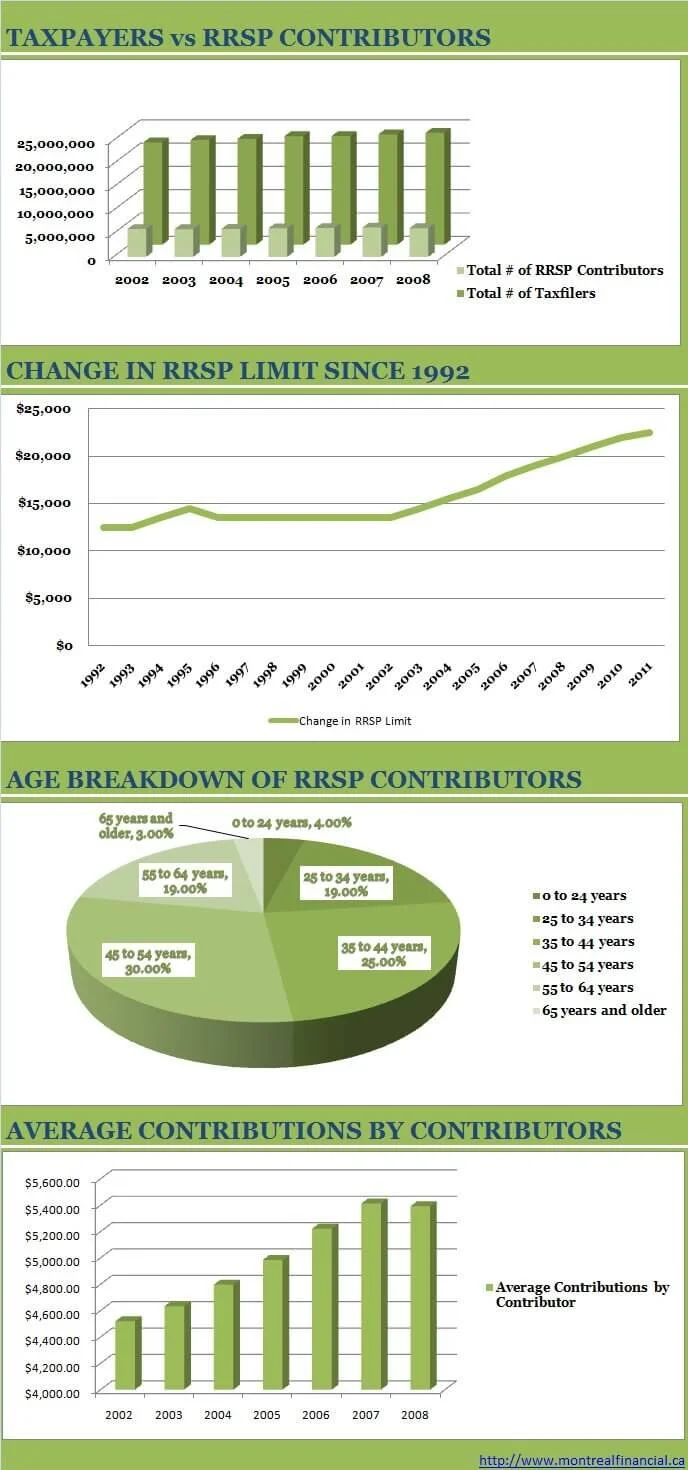

One of the most significant tax breaks available to Canadian taxpayers are contributions to retirement savings plans. As the contribution deadline approaches for 2010, I have compiled some facts and data into an infographic to provide some insight on how they work, and how we measure up to other Canadians:

QUICK FACTS ABOUT RRSPS

Acronym stands for Registered Retirement Savings Plan

First introduced in 1957

Designed to encourage Canadian taxpayers to build retirement savings

Contributions are tax deductible and reduce "taxable income"

Contribution deadline for 2010 is March 1, 2011

Taxpayers are allowed to contribute up to 18% of their prior year "earned income" less pension adjustment

Total Contribution room is indicated on assessment from Revenue Canada.

Maximum contribution for 2010 is $22,000

Unused RRSP contributions are carried forward indefinitely

Withholding taxes apply on early withdrawal of RRSPs. Amounts withdrawn are included in income for the year and taxed at marginal tax rate. Contribution room for amounts withdrawn is lost.

First time home buyers may borrow up to $25,000 against RRSPs for purchase of their homes.

At the latest, RRSP contributions must be cashed out or converted to RRIFs in the year that the taxpayer turns 71

Only $2,000 above your maximum limit can be contributed in any one year.

Related Articles:

Ronika Khanna is a Montreal based accountant who helps small businesses achieve their financial goals. To receive regular updates of articles pertaining to small business, accounting, tax and other topics of interest to business owners you can sign up here. You can also follow her on Linkedin.