Adopt These 9 Money Habits to Increase Your Net Worth

One way to reinforce habits is to celebrate small wins. If you eat slightly less junk food or exercise a bit more, you can count it as an accomplishment. The positive reinforcement helps to make us feel better, inspire confidence and slowly build habits that makes reaching our goals a bit easier. This is particularly true with financial discipline. It is important to recognize that, like any habit, it is a process that takes time. The good news is that there are tangible metrics to measure your success e.g. when you have more in your investment accounts or a higher net worth.

7 Lesser Know Facts About RRSPs

It is the time of year when everyone adult Canadian should be thinking about investing into their registered retirement savings plan (RRSP) prior to the deadline of March 1st. Many of you might think that you are young and have time or conversely that you are older and it’s too late. The truth is that it is never too early or late to start a RRSP. You simply need to set a goal and start doing it.

The great benefit of investing in RRSPs, which is the single best tax optimization strategy available to all Canadians, is that it reduces the amount of income taxes that you will have to pay. The tax savings is based on your marginal tax rate. Since everyone’s income is allocated to different tax brackets as your income increases, the marginal tax rate represents the highest tax bracket which applies to the top portion of your income.

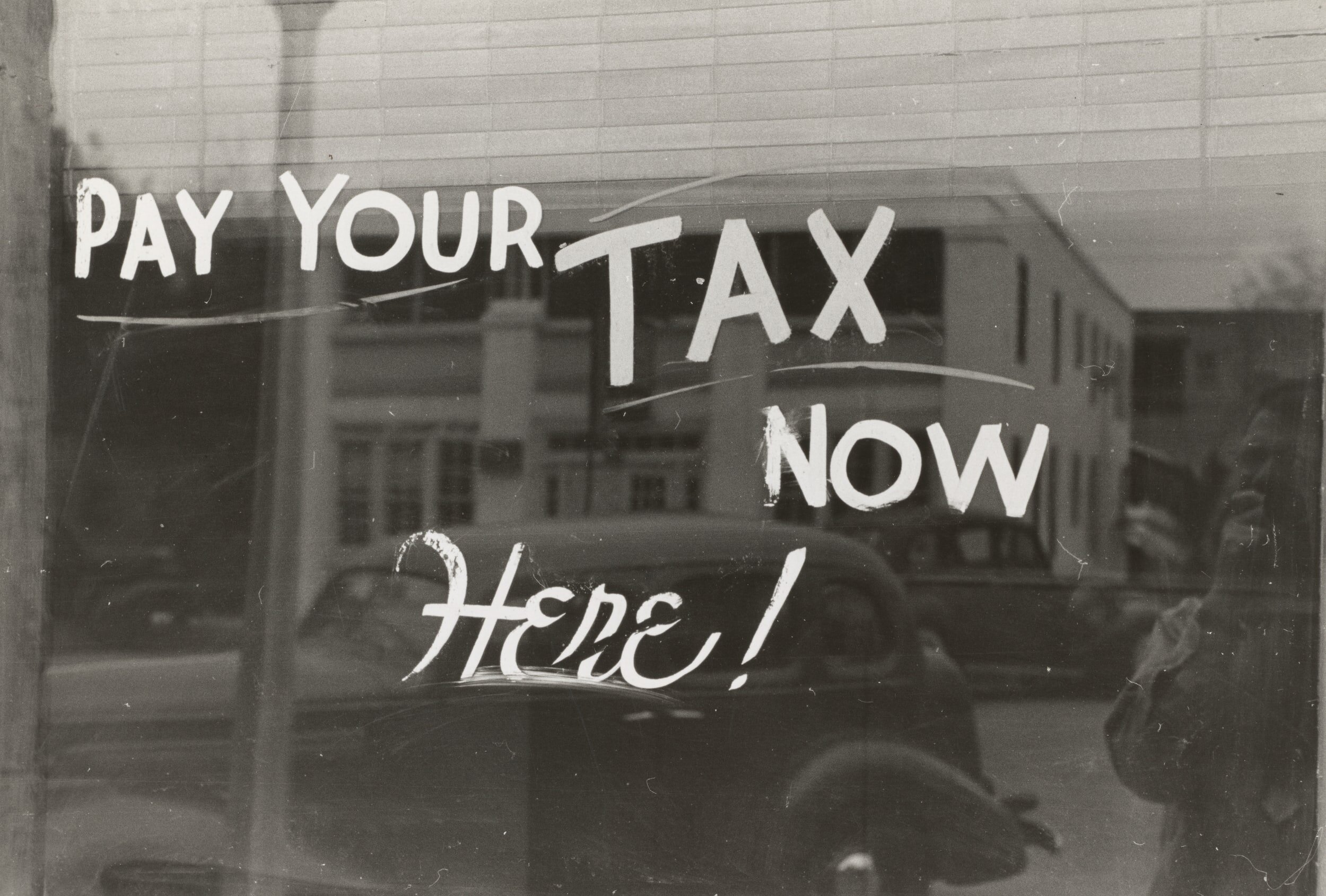

Tax Deductions vs Tax Credits and 5 Tax Deductions to Help Reduce Your Tax Bill

Most taxpayers use the terms tax deduction and tax credit interchangeably. Since they are not accountants, this is perfectly fine unless you are particular about precision and strive for a greater understanding of tax. And while there a numerous technicalities and jargon in tax that are better left to tax professionals, this particular distinction is fairly straightforward , can useful to understand and might even save you some tax.

So, what is the difference? A tax deduction is a reduction of your net income on which your taxes payable are based, while a tax credit is a direct reduction of your taxes payable. These might sound very similar, but their impact on how much tax you pay is different. Since there are different tax brackets, a tax deduction results in a reduction of your taxes payable effectively at the highest tax bracket to which your income applies, while a tax credit (for simplicity we are only talking about the federal portion and not provincial) will only reduce your taxes by 15%, which corresponds to the lowest tax bracket. While this can get significantly more complicated, suffice it to say, if your income exceeds approximately $50k, tax deductions have a higher value i.e. they reduce your taxes by a greater amount than a tax credit since part of the $50k will be taxed based on a higher tax bracket.