COVID-19 Details on Canada 75% Wage Subsidy for Businesses with Employees (CEWS)

Businesses who have employees that are on payroll (i.e. for whom deductions at source is being remitted and T4s/RL1s are being issued) are entitled to a Wage Subsidy of 75% of the employees’ gross payroll up to a maximum of $847 per week referred to as Canadian Emergency Wage Subsidy or CEWS. This should prove to be very helpful to businesses who don’t want to let employees go but due to reductions (or complete stoppage) of revenues may not be able to afford to pay them. It provides for business continuity and financial relief to a significant subsection of the population.

COVID-19: Financial and Tax Relief Measures for Small Business and Individuals (UPDATED)

UPDATED APRIL 27, 2020

In response to the financial pressure being felt by small business, employees and individuals as a result of COVID-19, a number of measures have been announced by governments and banks to alleviate this difficulty These are enumerated in this post and while details relating to eligibility, how to apply etc. on the measures announced by the federal government today are still forthcoming, small businesses and individuals now know what types of financial relief they may be eligible for and can start preparing accordingly.

Tips and Tools for Working from Home

Having a home based business has many advantages - there's no wearying commute to and from work, our sleep schedule is not beholden to an alarm clock and it allows us to work, if we so choose, when we are at our most productive or creative. An additional benefit is that expenses relating to our home office are tax deductible. Working from home can, however, also present a unique set of challenges. Given the proximity of distractions including our beds, fridges , tvs and perhaps worst of all, our computers, it requires a great deal of discipline and focus to actually get any work done.

Impact of COVID-19 on Small Business and Their Employees(UPDATED): EI Sickness and EI Regular Benefits

Updated on March 30, 2020 for CERB which will replace the EI benefits in the short term.

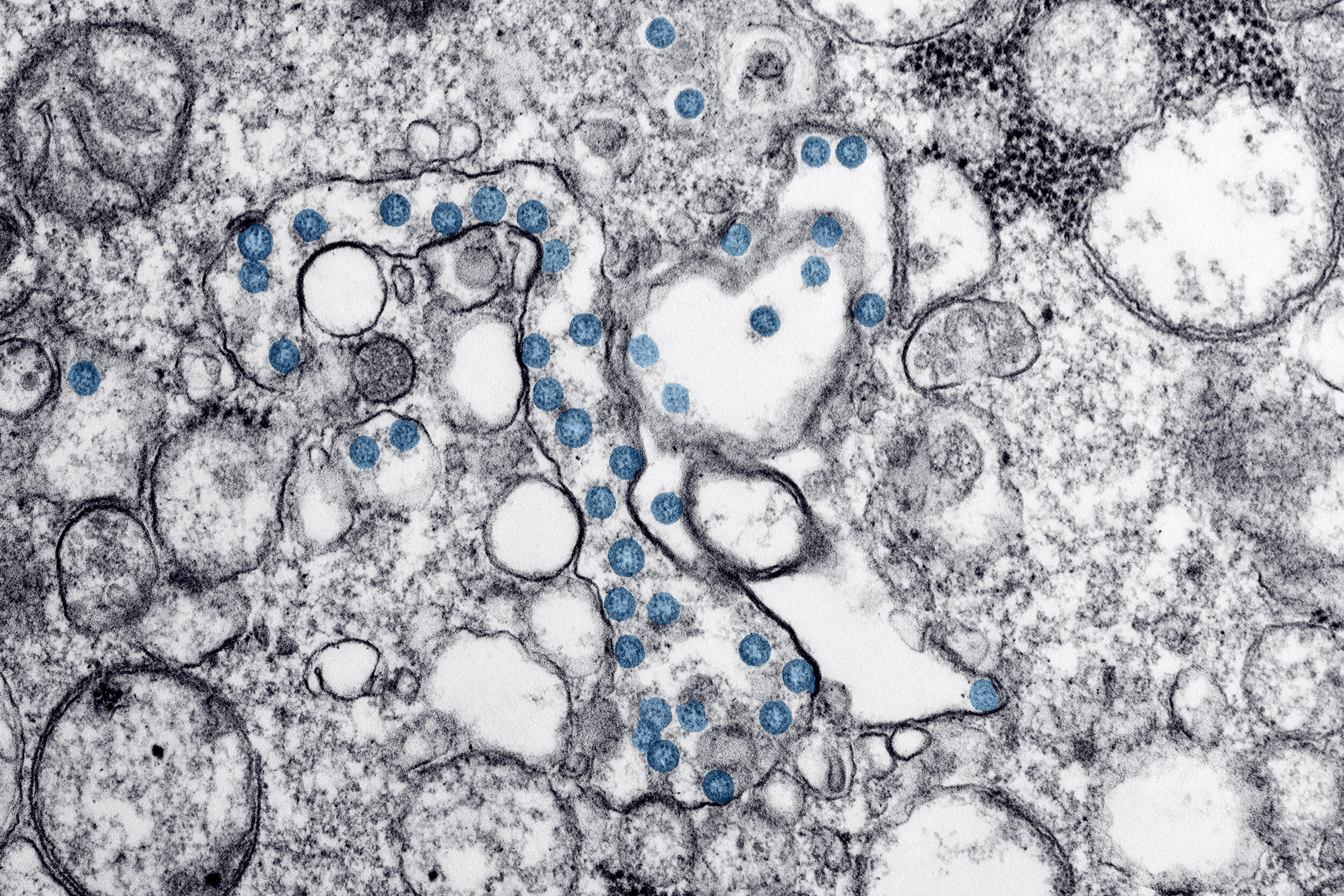

The impact of Covid 19 (caused by the CoronaVirus) is being felt deeply all across the world right now as individuals, businesses, healthcare institutions and governments try to cope with the ongoing and evolving implications. It is a difficult time as individuals try not to panic and governments are endeavouring to decide the best course of action for their citizens. Small businesses are experiencing are experiencing dramatic slowdowns or are being forced to close as customers stay at home.

Businesses who have employees that are quarantining themselves due travel or potential contact with the Coronavirus as well as employees who are laid off are entitled to EI Benefits. While there have been some changes to the sickness benefits in the face of Covid 19, EI benefits currently remain the same and are explained below:

Business and Tax Implications of Owning Rental Property

A great many fortunes have been made in real estate. Conversely, as was evidenced in 2008 with the deflation of the housing bubble, many fortunes have also been spectacularly lost. Fortunes aside, owning real estate is one of the best ways to build equity. If you own your home, you are already one step ahead. With rental property, you can further augment your net worth if after investing the necessary down payment the rental income covers and/or exceeds the mortgage payment and related expenses, (Leaving you free to move on to buying your next property). This is not a decision to take lightly as with any investment there are several business and tax factors to consider before taking the plunge:

Employment Insurance for Small Business Owners and Self Employed Individuals

One of the benefits allowed employees working in Canada is that have access to employment insurance. A specific amount is withdrawn from each employees paycheques each pay period along with an employer portion and remitted to Revenue Canada. This entitles them to wage loss replacement, in the event that they are laid off, as well as other benefits. This can be extremely useful in difficult times and has been used by millions of Canadians.

Unfortunately, taxpayers who are considered self employed are not entitled to the same benefits. A self employed individual also includes anyone who owns 40% of a corporation and usually extends to family members of self employed people. By the same token, self employed taxpayers (whether they are sole proprietorships or owners of corporations) are also not required to pay employment insurance (EI) premiums.

9 Tax Facts about Charitable Donations for Individuals and Small Business Owners

Every good act is charity. A man's true wealth hereafter is the good that he does in this world to his fellows. - Moliere. Unfortunately, the Canada Revenue Agency (CRA) has specific criteria for what qualifies as a charitable donation and not all good acts qualify for a tax benefit. Growing a moustache (although not without its costs) or running a marathon, are generally not considered to be a charitable donations according to the tax code. Luckily there are a multitude of charitable organizations that do qualify the donors to receive a tax credit for their donations. Some facts about the tax credit are discussed below:

Should You Pay Yourself a Salary or Dividend? 7 Considerations For Small Business Owners

While incorporation has many benefits for small business owners, it does introduce additional complexities that are not faced by registered businesses. Unincorporated business owners are essentially taxed on their net business income, which allows for more time to devote to tax planning and how to spend all of your richly deserved profits. Incorporated business owners, on the other hand, cannot just withdraw cash from their businesses as the need or whim arises. There needs to be a formalized structure in place which usually takes the form of either salary or dividends. Either type of remuneration has tax and other implications that need to be considered before making a decision.

24 Cost Effective Ways to Promote Your Small Business

After thinking long and hard you have decided that is time to launch your own business. You have a great product or service, you’ve come up with a compelling business name, all the paperwork has been filed and you have picked out the perfect location (or setup a snazzy new home office). All pieces are in place for your new independent life as a business owner. And then you realize that nobody except your spouse, family members and possibly your cat knows about your new venture. So, how do you bring your fabulous new product or service to your target market's attention? One way is to use the “build it and they will come” approach. This is usually not particularly effective (even Google, who historically launches products with little fanfare, could benefit from a little more marketing). The other, more effective approach is to get out there and promote your business. Of course in the initial stages, marketing budgets tend to be minuscule. On the other hand, many new business owners have time on their hands, while they wait to be deluged by orders. Below is a list of 24 cost effective ways to promote your small business:

Investment Strategies for Your Incorporated Small Business

One of the benefits of having an incorporated small business is that after paying yourself a salary or dividend any excess funds can be invested directly through the corporation. Since small businesses often cannot predict how their business will perform from year to year, the ability to retain funds in the corporation allows for a cushion to smooth out fluctuations in earnings which can then be paid out in lower performing years. By keeping the funds in the corporation, the business is able to defer tax since usually the small business tax rate is lower than the personal tax rate. Some points to consider:

4 Alternatives for Preparing Your Small Business Payroll

Paying salaries to employees (or yourself) requires more than just determining the gross amount to be paid. The Canada Revenue Agency and Revenue Quebec require that employers calculate a variety of taxes on the salaries paid, remit them to the federal and provincial governments and prepare annual reports demonstrating that the calculations are correct and all salary deductions have been paid. This can be a lot of work for business owners whose time is better spent generating sales and building their businesses. Luckily there are many options for small business owners to calculate their payroll and salary remittances, many of which simplify the process:

How to Set Up a Small Business Accounting System

Many small business owners (myself included) tend to focus on the more glamourous aspects of their business eg. sales, marketing and product/service development. As a result, accounting often does not get the attention it deserves. In addition to the perception that an accounting system does not necessarily add value, it can also be a little intimidating. However, there are numerous benefits to setting up an accounting system and it can actually be fairly straightforward especially if you have some help with setting it up. A good accounting software tends to handle most of the complexity of accounting as long as the data is compiled and entered accurately.

Why you should register for CRA and RQ My Business Account (and how to do it)

With all data moving to the cloud these days and ubiquitous online access to banking, customer and supplier portals, it makes sense that Revenue Canada (CRA) and Revenue Quebec (RQ) have followed suit. Considerable resources have been spent by the revenue agencies on developing their online portals and encouraging both individual taxpayers and businesses to move the majority of their tax related interactions online (almost every accountant conference has an appearance by a CRA representative talking about the improvements to their online portal and imploring accountants to convince their clients to make the switch). The upfront investment has resulted in significant cost savings for CRA/RQ (postage costs alone have dropped dramatically) while improving accuracy and perhaps most importantly increasing the effectiveness of tax collection efforts. CRA personnel have been able to move away from verifying calculations and manually reviewing tax returns to more value added analysis which has allowed them to identify tax miscreants with higher accuracy.

For both the individual taxpayer and small business owner there are numerous benefits to registering online:

Revenue Canada Interest, Penalties and Payment Arrangements for Income Tax and GST/HST Returns

Whether you are an individual or a business in Canada, taxes are an inescapable part of your existence. All sources of income need to be calculated, tax returns needs to be filed and taxes owing must be paid. This is somewhat facilitated if you are an employee as your employer tends to take care of the majority of remittances. Self-employed individuals, sole proprietorships, partnerships and corporations on the other hand, must account for their income and expenses , determine taxes payable and remit the appropriate amounts. Additionally, businesses are also responsible for other filings including GST/HST and QST and payroll. A lack of knowledge, imperfect accounting systems and the business of running a business sometimes interfere with the timeliness of filings. The Canada Revenue Agency attempts to curb these tardy behaviours by imposing penalties and interest on late filings as follows:

Unincorporat

Are you Ready to Make the Transition to Self-Employment

There are many of to whom the promise of being one’s own boss as a self employed business owner seems extremely appealing (particularly if have an extensive set of "leisure"wear). You might crave the feeling of accomplishment that is no longer possible at your current place of employment or you seek greater flexibility and love the idea of working from home. Perhaps you feel that you are not being compensated adequately for your skills or the value that you add to your organization. Or you simply might find yourself bored and uninspired, scouring social media sites for hours on end, and realize that you need a change of pace.