19 Features to Consider When Selecting Small Business Accounting Software

A good accounting software can be an invaluable tool for businesses. Before choosing an accounting software it helps to have a detailed understanding of what your accounting system can do for you . This involves analysing the key aspects of your business, determining what is essential (eg. invoicing, expenses, banking, reports) and what you would like to have (eg. time tracking, credit card payments, banking downloads etc.). By reviewing your requirements in advance and building a checklist, you can make a better decision about something that goes to the very foundation of your business. Below are some important features to consider:

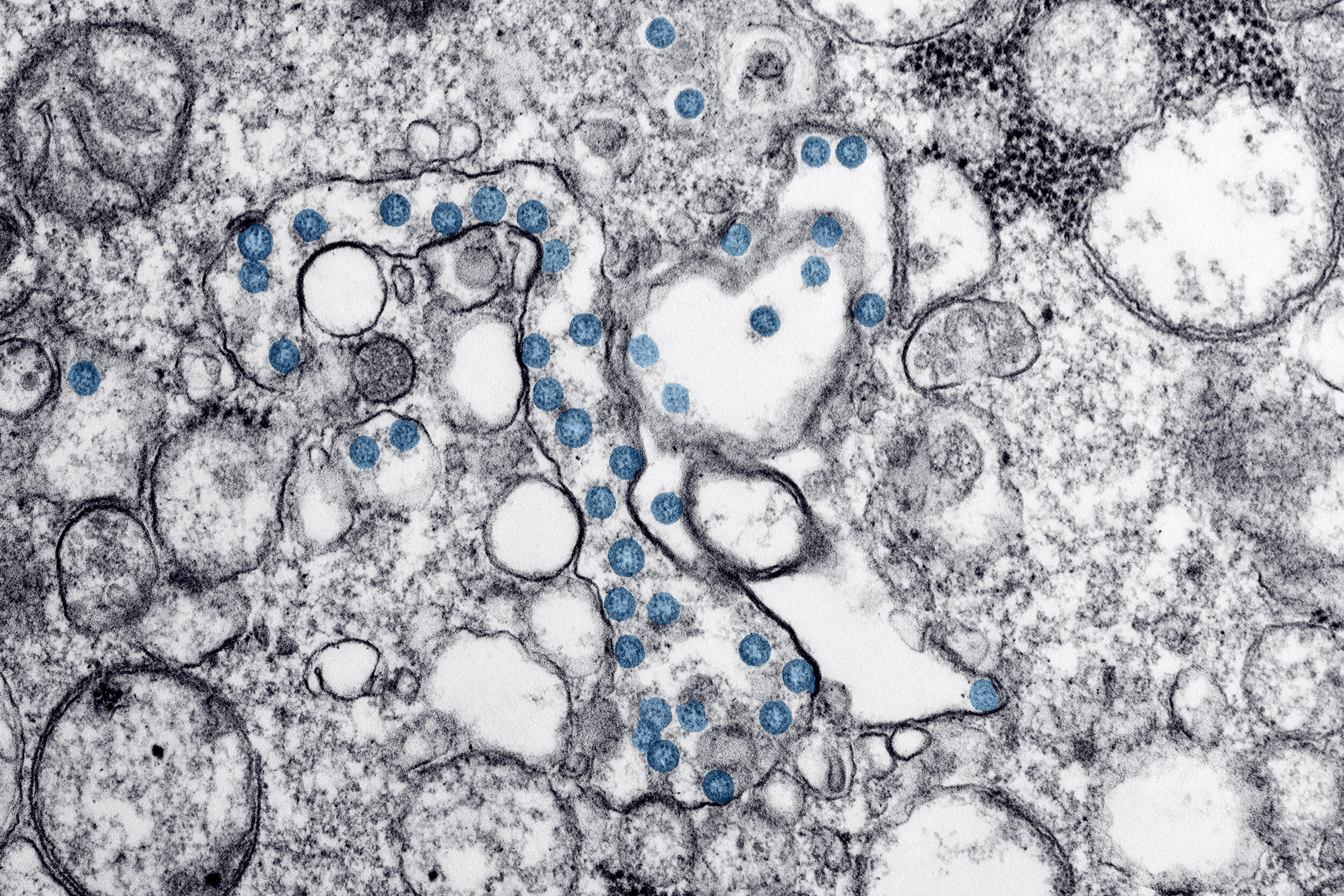

COVID-19: Financial and Tax Relief Measures for Small Business and Individuals (UPDATED)

UPDATED APRIL 27, 2020

In response to the financial pressure being felt by small business, employees and individuals as a result of COVID-19, a number of measures have been announced by governments and banks to alleviate this difficulty These are enumerated in this post and while details relating to eligibility, how to apply etc. on the measures announced by the federal government today are still forthcoming, small businesses and individuals now know what types of financial relief they may be eligible for and can start preparing accordingly.

Tips and Tools for Working from Home

Having a home based business has many advantages - there's no wearying commute to and from work, our sleep schedule is not beholden to an alarm clock and it allows us to work, if we so choose, when we are at our most productive or creative. An additional benefit is that expenses relating to our home office are tax deductible. Working from home can, however, also present a unique set of challenges. Given the proximity of distractions including our beds, fridges , tvs and perhaps worst of all, our computers, it requires a great deal of discipline and focus to actually get any work done.

3 Online Accounting Software Options for Small Business

As cloud computing becomes ubiquitous, the number of cloud based online accounting software options continues to grow. Many small business owners want a software that has an intuitive and easy-to-use interface that allows them to bill customers, enter expenses, record bank transactions and generate financial statements and other reports,. We also want to be able to access the software from anywhere (you never know when the desire to do your accounting strikes!) and not be tied down to a specific location Below is a summary of 3 cost effective, multi functional alternatives :

Employment Insurance for Small Business Owners and Self Employed Individuals

One of the benefits allowed employees working in Canada is that have access to employment insurance. A specific amount is withdrawn from each employees paycheques each pay period along with an employer portion and remitted to Revenue Canada. This entitles them to wage loss replacement, in the event that they are laid off, as well as other benefits. This can be extremely useful in difficult times and has been used by millions of Canadians.

Unfortunately, taxpayers who are considered self employed are not entitled to the same benefits. A self employed individual also includes anyone who owns 40% of a corporation and usually extends to family members of self employed people. By the same token, self employed taxpayers (whether they are sole proprietorships or owners of corporations) are also not required to pay employment insurance (EI) premiums.

Pros and Cons of Incorporating your small business

The decision to incorporate can be a difficult one that many small businesses face at some point in their lifetime and . Incorporation, literally, represents the creation of a new person. Whereas a sole proprietorship is an extension of one's self, a corporation takes on a life of it's own; it can give birth to subsidiary, marry via a merger and die with a dissolution. It has to file it's own tax return, can be sued and has a set of rules that govern it's existence. Below are some of the points to consider when deciding whether to incorporate:

Employee vs. Self Employed: Criteria and Considerations

For the majority of income earners, employment status is pretty evident. If you are going to the same place every day, have an assigned cubicle with a computer and a corporate stapler, and you have a boss that tells you what you need to do, chances are you are an employee. Conversely if you have several clients, use your own laptop, and are worried about where your next sale is going to come from, you are probably self employed.

There are, however, some workers whose status is not that apparent. For example you may work from home and use your own computer, but you report to one entity, where someone supervises and directs your work. In these cases a determination needs to be made as to whether you are an employee or self employed. It is not enough for the person paying you to determine your classification ; often, payers are biased as they may not want to take on the financial costs and responsibilities of having an employee (explained below). As such, when in doubt about your status, it is helpful to answer the following questions:

24 Cost Effective Ways to Promote Your Small Business

After thinking long and hard you have decided that is time to launch your own business. You have a great product or service, you’ve come up with a compelling business name, all the paperwork has been filed and you have picked out the perfect location (or setup a snazzy new home office). All pieces are in place for your new independent life as a business owner. And then you realize that nobody except your spouse, family members and possibly your cat knows about your new venture. So, how do you bring your fabulous new product or service to your target market's attention? One way is to use the “build it and they will come” approach. This is usually not particularly effective (even Google, who historically launches products with little fanfare, could benefit from a little more marketing). The other, more effective approach is to get out there and promote your business. Of course in the initial stages, marketing budgets tend to be minuscule. On the other hand, many new business owners have time on their hands, while they wait to be deluged by orders. Below is a list of 24 cost effective ways to promote your small business:

How to Set Up a Small Business Accounting System

Many small business owners (myself included) tend to focus on the more glamourous aspects of their business eg. sales, marketing and product/service development. As a result, accounting often does not get the attention it deserves. In addition to the perception that an accounting system does not necessarily add value, it can also be a little intimidating. However, there are numerous benefits to setting up an accounting system and it can actually be fairly straightforward especially if you have some help with setting it up. A good accounting software tends to handle most of the complexity of accounting as long as the data is compiled and entered accurately.

Revenue Canada Interest, Penalties and Payment Arrangements for Income Tax and GST/HST Returns

Whether you are an individual or a business in Canada, taxes are an inescapable part of your existence. All sources of income need to be calculated, tax returns needs to be filed and taxes owing must be paid. This is somewhat facilitated if you are an employee as your employer tends to take care of the majority of remittances. Self-employed individuals, sole proprietorships, partnerships and corporations on the other hand, must account for their income and expenses , determine taxes payable and remit the appropriate amounts. Additionally, businesses are also responsible for other filings including GST/HST and QST and payroll. A lack of knowledge, imperfect accounting systems and the business of running a business sometimes interfere with the timeliness of filings. The Canada Revenue Agency attempts to curb these tardy behaviours by imposing penalties and interest on late filings as follows:

Unincorporat

Are you Ready to Make the Transition to Self-Employment

There are many of to whom the promise of being one’s own boss as a self employed business owner seems extremely appealing (particularly if have an extensive set of "leisure"wear). You might crave the feeling of accomplishment that is no longer possible at your current place of employment or you seek greater flexibility and love the idea of working from home. Perhaps you feel that you are not being compensated adequately for your skills or the value that you add to your organization. Or you simply might find yourself bored and uninspired, scouring social media sites for hours on end, and realize that you need a change of pace.

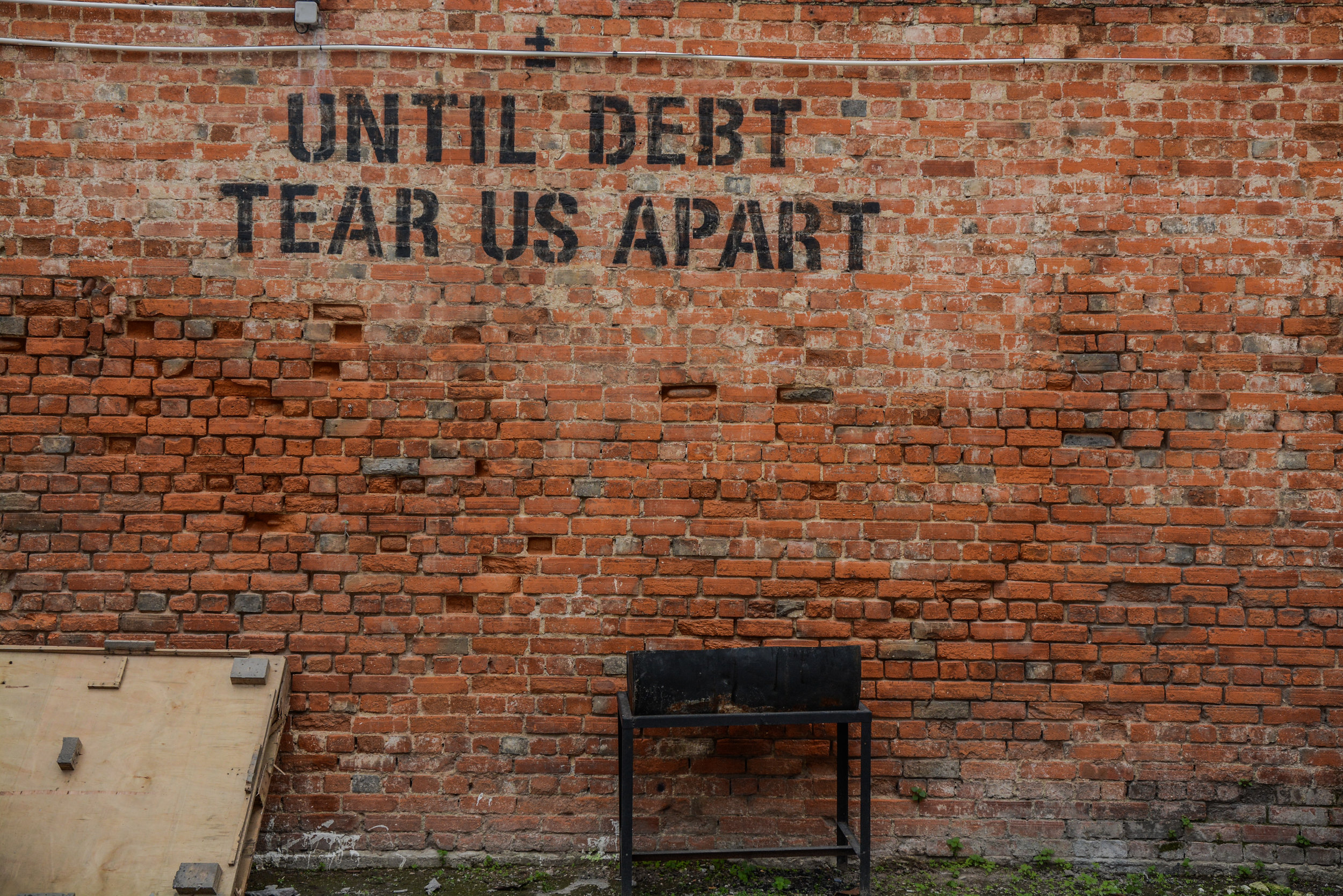

7 Reasons Why Debt is Good for Your Business

Debt is often perceived negatively. Debt can be “evil”, “crippling” and an “unforgiving master”( the last one from the Google query “Debt is…”;). It suggests a lack of sufficient cash flow and an inability to fulfil your funding requirements. It also an indication of increased risk, as if you are unable to service your debt repayments, it could have dire consequences for your business (see American Apparel). There is however another side to debt. The majority of large corporations have some level of debt. It can be a great way for individuals to earn a return on their investment. And of course it is an integral part of the engine that drives the world economy. For small business owners, debt can actually provide some great benefits as long as it is managed responsibly. Some of these are discussed below:

Understanding Payroll Deductions: Personal Income Tax Rates, CPP/QPP, EI and Basic Exemption

The automation of the tax preparation and filing process has been a boon to individuals and tax preparers alike. Gone are the days of struggling to find the right box on the return, adding everything up 5 times and still getting different results, and hoping that the CRA can read your chicken scrawl. Present day tax software not only guides you through every step of the process, it also helps to optimize your allocations thereby reducing your taxes payable. There is however at least one downside to automation: Since we are more removed from the actual calculations, our understanding of our tax situation is somewhat diminished. We have an idea of what we expect to pay, which we can see every week on our paycheques (or for self employed individuals, the breathtaking moment when we see the final result on our tax return), but often we are not really sure how these amounts are derived. Below is a discussion of the tax rates, deductions and maximums to improve our comprehension of this somewhat complex topic:

Quebec Parental Benefits for Self Employed Workers

In Canada parental benefits are administered by Service Canada. Since they fall under the EI program, self employed workers must opt in tothe EI plan for self employed individuals to receive benefits. In Quebec however, unlike the rest of Canada (a common theme with Quebec), parental benefits are administered by the Quebec Parental Insurance Plan (QPIP), which does not specifically require opt in. Instead all workers in Quebec whether self employed or employees are required to pay premiums, based (similar to QPP) on their insurable earnings. For the self employed, premiums are payable at a rate of 0.86% upto maximum insurable earnings of $62,000, and are reflected in your annual tax return. As such all workers in Quebec are eligible for Parental Benefits.