What Are Bank Reconciliations and Why Every Business Should Do Them

Many small business and self employed owners take on the responsibility of doing their own accounting. You may do all of your own accounting from set up to preparing your own small business tax return OR you may have an accountant who simply takes care of your year end and tax reporting. Accounting software has made doing your own accounting much simpler and allows for most business owners to do it, regardless of whether they have some sort of accounting background. There is however a learning curve and certain accounting steps that not everyone is aware of and that are very important to ensure the accuracy of your books. One of these is are bank reconciliations.

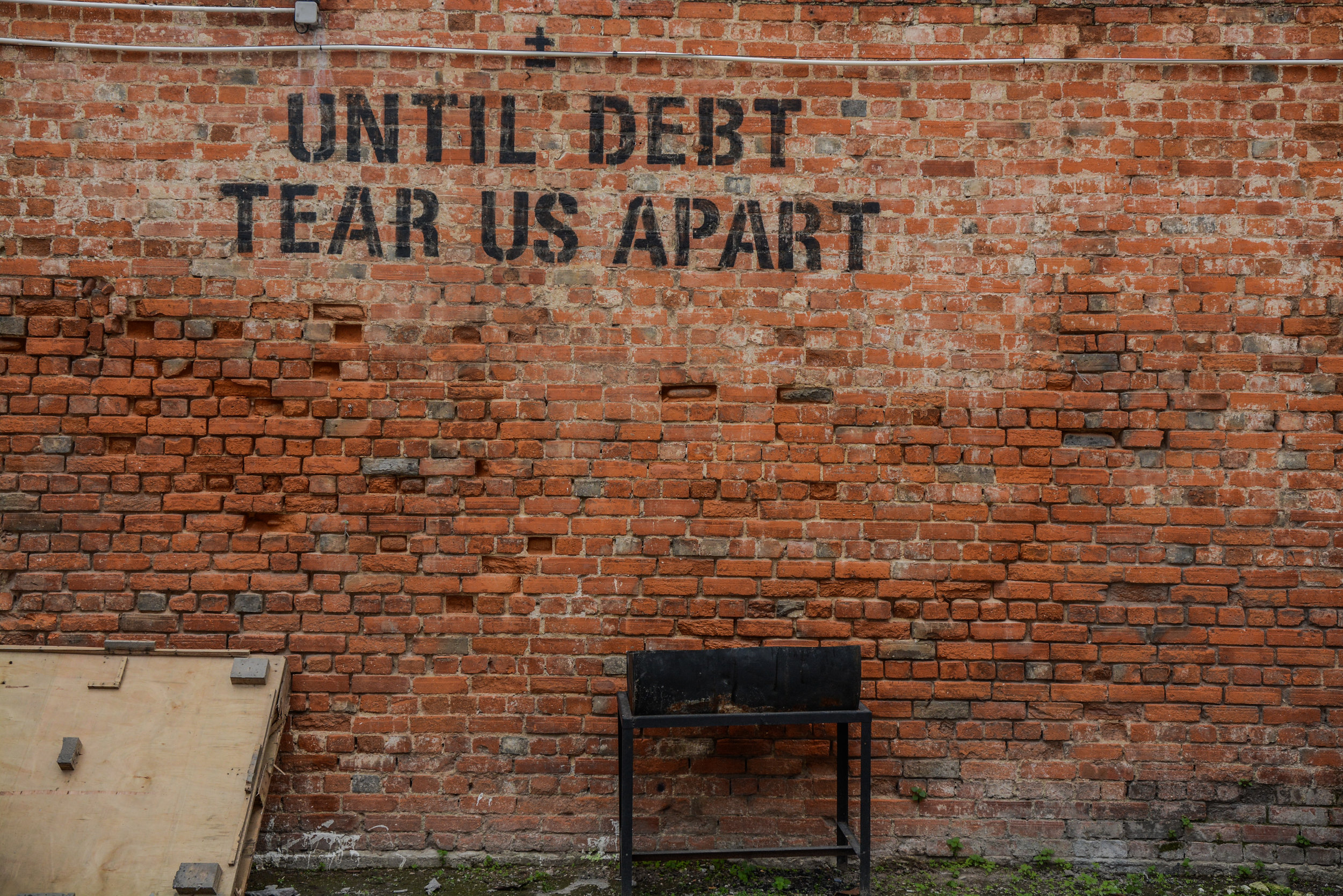

7 Reasons Why Debt is Good for Your Business

Debt is often perceived negatively. Debt can be “evil”, “crippling” and an “unforgiving master”( the last one from the Google query “Debt is…”;). It suggests a lack of sufficient cash flow and an inability to fulfil your funding requirements. It also an indication of increased risk, as if you are unable to service your debt repayments, it could have dire consequences for your business (see American Apparel). There is however another side to debt. The majority of large corporations have some level of debt. It can be a great way for individuals to earn a return on their investment. And of course it is an integral part of the engine that drives the world economy. For small business owners, debt can actually provide some great benefits as long as it is managed responsibly. Some of these are discussed below: