9 Tips For Managing Your Customer Receivables

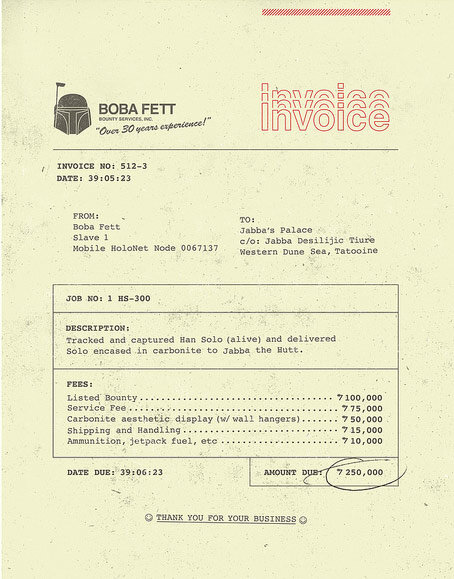

Any sales that occur within a business where payment is not made up front (eg. retail) or in advance of the sale (eg. down payment for a car), is reflected as an “Accounts Receivable”, which is accounting terminology for amounts owing by customers to a business. It is good to have accounts receivable, as this means you are generating sales. The downside, however, of having accounts receivable is that it represents cash that you don't have now, and along with that comes the possibility that your customers won’t pay you. Luckily a good system to manage your accounts receivable will help to reduce the number of non paying customers thereby avoiding bad debts. Below are some steps to help manage and collect on your accounts receivable:

7 Qualities of Highly Desirable Clients

When you are a business owner/freelancer, there is wonderful feeling of gratification when you land a great client. These are clients that ask great questions, respect our work and make us feel happy to have chosen the entrepreneurial route. Then there are the not so great clients who have unrealistic expectations, are unimaginative and often just plain clueless.

It should also go without saying that we must also do what it takes to be provide an excellent experience to our clients and customers. It is not dissimilar from being in a relationship with a partner or spouse and for both sides to get the most out of it, you as the service provider, must also be responsive, respectful, fair and transparent.

Should New Business Owners Register for GST/HST?

The Goods and Services Tax or GST is a consumption tax that is charged on most goods and services sold within Canada, regardless of where your business is located. Subject to certain exceptions, all businesses are required to charge GST , currently at 5%, plus applicable provincial sales taxes. A business effectively acts as an agent for Revenue Canada by collecting the taxes and remitting them on a periodic basis. Businesses are also permitted to claim the taxes paid on expenses incurred that relate to their business activities. These are referred to as Input Tax Credits.

Excel for Small Business Owners

As a confirmed excel nerd, there is something about large amounts of data that I am inextricably drawn towards . I suppose it has something to do with an affinity for organization combined with a love of numbers and the innate desire to solve problems. As an accountant and financial consultant , I am often presented with the task of organizing and analysing data into a format that allows for greater insight into my clients businesses . And although good accounting software is important for most small business owners, especially once they reach a certain size, a great deal of analysis and reporting is done most effectively in excel.

Tips and Tools for Working from Home

Having a home based business has many advantages - there's no wearying commute to and from work, our sleep schedule is not beholden to an alarm clock and it allows us to work, if we so choose, when we are at our most productive or creative. An additional benefit is that expenses relating to our home office are tax deductible. Working from home can, however, also present a unique set of challenges. Given the proximity of distractions including our beds, fridges , tvs and perhaps worst of all, our computers, it requires a great deal of discipline and focus to actually get any work done.

Accounting for Non Accountants : Debit, Credits and Financial Statements

When people hear the term accounting, there is an involuntary reaction whereby the comprehension centres (the medical term) of their brains tend to shut down, and sleep mode is activated. This is unfortunate, as accounting, especially to a small business owner, can actually be quite interesting. It is one of the primary tools by which business owners and other interested parties can gage the success of their business, as well as identify areas that require attention andneed improvement. To understand accounting, business owners need to have a basic understanding of how it works (debits and credits) and it's results (financial statements), explained below:

The Many Hats of Self Employment

Being self employed comes with many benefits. You can sleep in, work in your pyjamas and go shopping in the middle of the day. You no longer have to report to a boss who doesn't really understand what you do or deal with mindless workplace politics. It all sounds wonderful, but unfortunately there are also many challenges. Small business owners have to deal with uncertainty and risk. They need to be disciplined and deal with the many demands that being self employed can impose upon us. In the early stages of self employment, most of us have to take on the responsiblity of fulfilling the administrative functions that you find in a more established business. Some of the skills that you need to develop are:

Breaking Up with a (Likeable) Client

Many of us have clients who are annoying, cheap, stupid , high maintenance or some combination thereof. As a new business owner, we are often stuck with these clients because we need them. However, we look forward to the day when we will have the thriving business that we so deserve, and fantasize about the spectacular way in which are going to fire them (you can shove your business into your rear orifice etc.) This is actually a productive fantasy as can help to channel and concentrate anger. Of course, in the majority of cases, a firing should be conducted with slightly less vigour.