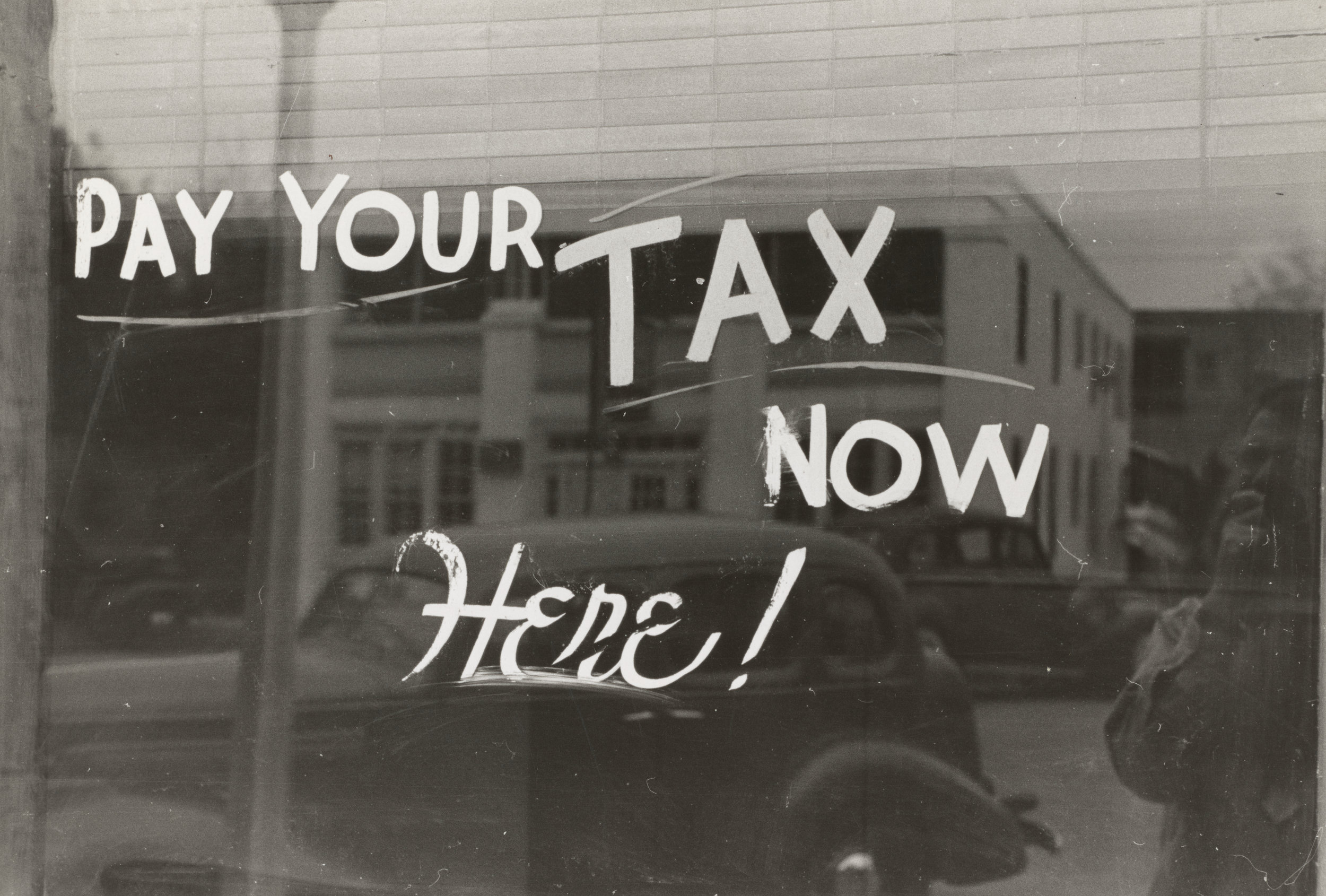

Know Your Small Business Tax Deadlines In 2025

As we approach the new year, it is time to start thinking about a subject near and dear to your heart i.e. taxes (insert appropriate emoji).

Below are the deadlines that all small businesses need to know for 2025.

5 Reasons to Change Your GST/HST/QST Reporting Period and How to Do It

When starting a business the selection of the GST/HST or QST reporting period i.e. how often to file your sales tax returns is often based on new business considerations. Many new business owners are quite enthusiastic and/or orderly and therefore would prefer to file their reports and pay the balance owing on a more regular basis. Conversely owners might be concentrating on the other aspects of running their business and do not want to be bothered with the administrative hassle of regular monthly or quarterly reporting. In this case, you might select the annual reporting option to make the year end reporting requirements as simple as possible. As time passes and your business evolves, you might realize that the option that you initially selected may no longer be the most optimal.

Revenue Canada Interest, Penalties and Payment Arrangements for Income Tax and GST/HST Returns

Whether you are an individual or a business in Canada, taxes are an inescapable part of your existence. All sources of income need to be calculated, tax returns needs to be filed and taxes owing must be paid. This is somewhat facilitated if you are an employee as your employer tends to take care of the majority of remittances. Self-employed individuals, sole proprietorships, partnerships and corporations on the other hand, must account for their income and expenses , determine taxes payable and remit the appropriate amounts. Additionally, businesses are also responsible for other filings including GST/HST and QST and payroll. A lack of knowledge, imperfect accounting systems and the business of running a business sometimes interfere with the timeliness of filings. The Canada Revenue Agency attempts to curb these tardy behaviours by imposing penalties and interest on late filings as follows:

Unincorporat

Is the Quick Method of Reporting GST/HST & QST the Right Choice for your Small Business

If you are self employed or a small business with annual sales between $30,000 and $400,000, it might make sense to select the Quick Method of reporting your GST/HST and QST, which is essentially a simplified method of reporting sales taxes . While regular reporting of sales taxes requires that you calculate all amounts collected and paid on eligible expenses, the quick method (or simplified method as it is also referred to)requires the application of a single reduced rate to your sales while GST/HST and QST paid on expenses is not deductible. The key details of the Quick Method and its suitability for your business are discussed below:

Tax Obligations Every Canadian Small Business Should Know

It is therefore prudent for both sole proprietorships and incorporated businesses to keep on top of their tax filings.

In this article I enumerate the tax obligations for most small businesses in Canada along with links to articles to help you understand each one better.

Should New Business Owners Register for GST/HST?

The Goods and Services Tax or GST is a consumption tax that is charged on most goods and services sold within Canada, regardless of where your business is located. Subject to certain exceptions, all businesses are required to charge GST , currently at 5%, plus applicable provincial sales taxes. A business effectively acts as an agent for Revenue Canada by collecting the taxes and remitting them on a periodic basis. Businesses are also permitted to claim the taxes paid on expenses incurred that relate to their business activities. These are referred to as Input Tax Credits.

Frequently Asked Questions About GST/HST By Business Owners

For those of you who are starting a new business, it is essential to know your tax obligations. Every business owner must report their net profits on a either their personal tax return if they are unincorporated or a corporation tax return if they are incorporated.

In addition to income tax, it is essential to consider whether or not you should register and collect GST/HST and provincial sales taxes. There are a variety of questions around this topic:

Know Your Small Business Tax Deadlines For 2024

As we approach the new year, it will be time soon to start working on everyone’s favourite activity i.e. getting your tax stuff in order :) . Below are the deadlines that all small businesses need to know for 2024.

Download our free Canada unincorporated business tax deadline calendar for 2024 (both Federal and Quebec).

A Guide to Navigating Taxes in the Gig Economy

In a recent study by H&R Block, nearly 28% of Canadians reported taking on a side hustle in the “gig economy” to boost their income. This is a significant increase from 2022 in which the analogous percentage was 13%. This is likely a result of inflationary pressures and the expansion of opportunities available for flexible work.

The gig economy, popularized by Uber, refers to work that is flexible and usually incorporates digital apps or platforms.

Gig workers tend to be independent contractors who usually decide when they are going to work, often bring their own “tools” (such as a car or a computer) and are required to report their earnings to tax authorities.

Should you register for GST/HST and QST and What it Means to Be Zero Rated

When starting your new Canadian small business or launching into self employment, it is essential to determine whether you are required to register for GST/HST (and QST if you have a started a business in Quebec). The simple answer is that if you anticipate that your annual gross revenues (total sales) are going to exceed $30,000 and your products or services do not qualify as Exempt or Zero rated (explained below) , then you are required to register for GST/HST and collect sales taxes from your Canadian customers and clients. The $30,000 limit applies to the last 4 quarters of revenues. If you decide not to register for sales tax upon the inception of your business/self employment, then you must monitor your sales revenues over a rolling 4 quarter period and register once you are close.

Know Your Small Business Tax Deadlines For 2023

Somehow we are almost one month into 2023 (!) and it is time for business owners (and individuals) to start thinking about one of their favourite subjects i.e. taxes. I have compiled a list of the deadlines that all of you should know and also updated my annual business tax deadline calendar.

Sign up to download our free Canada unincorporated business tax deadline calendar for 2023 or Quebec unincorporated small business tax deadline calendar 2023.

Know Your Small Business Tax Deadlines For 2022

With the beginning of a new year upon us, tax submission deadlines for individuals and businesses are starting to loom. Every small business owner must adhere to these deadlines or risk facing penalties for late filing of returns plus interest on any overdue balances. Knowing these deadlines can help you ensure that you don’t simply waste your hard earned money and run afoul of CRA and RQ. I have compiled a list of deadlines for all unincorporated small business owners which includes sole proprietors and self employed individuals.

Note that the usual deadline for sales tax (GST/HST and QST) payments and income tax returns is April 30th. However, since this falls on a Saturday, the deadline is pushed to Monday, May 2nd, 2022.

How to Update Quickbooks for the 2011 QST Rate Increase

Update: As of January 1st, 2012 the Quebec Sales Tax (QST Rate) which had gone up from 7.5% to 8.5% on January 1, 2011 will now increase to 9.5%. The effective sales tax in Quebec will go up from 13.925% to 14.975%. Since QST is calculated on the net amount + GST, the effective rate is actually 14.975% (and not 14.5%) . In other words the effective QST rate is 9.975%. The instructions below are equally applicable, except the new QST rate to enter is 9.5%.

On January 1st, 2011, Revenue Quebec will be increasing the QST rate to 8.5% (yay!), bringing the effective rate of QST to 8.925% andtotal sales taxes (GST and QST) to 13.925% (since the QST is actually charged on the net price + GST.) This will impact anyone who charges QST including small businesses and self employed individuals, and invoicing software and processes should be updated to reflect the change. Suffice it to say that there are no major changes in the application of the rates. For those of you using Quickbooks you will need to update the QST being charged on both sales and purchases.