4 Accounting Transactions that Use Journal Entries and How to Enter them in QBO

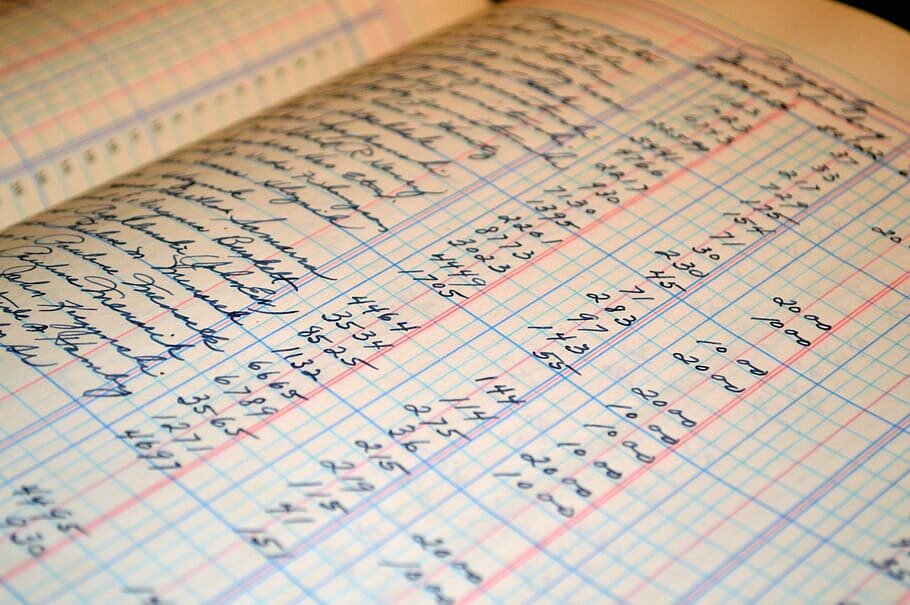

Accounting software has come a long way in the past few years. Although a good bookkeeper can be invaluable, It has become fairly easy for business owners and their support staff to take on the responsibility of entering day to day transactions while they employ accountants for the more complex aspects of their accounting and tax. While entering the majority of transactions in software, such as Quickbooks Online is fairly straightforward, there are transactions that require somewhat special treatment discussed below:

How to File T4s using Quickbooks Desktop

For all Canadian businesses that have employees on their payroll, the deadline to file your T4s is February 28th, The good news is that it has become much easier to prepare and submit the T4s particularly if you are submitting them electronically.. The Canada Revenue Agency (CRA) is encouraging businesses to file the T4s electronically and it should be noted that e-filing is mandatory for employers with more than 50 employees.

How to Enter Opening Balances in QBO Using a Journal Entry

There comes a time for many small businesses or self employed workers when they decide that their current accounting system is no longer working for them. This can be stressful as learning any new software is often tedious and more importantly you have to ensure proper continuity and a smooth transition.

Small businesses might decide to transition to a new accounting software for a variety of reasons:

You are currently using spreadsheets which have become difficult to manage

Your spreadsheets do not provide the data that you require to properly analyze your business

Your current accounting system is too technical and/or not user friendly

Your current accounting system does not have the features that you require

You want to be able to access your data online rather than through your desktop

See our detailed review on whether QBO is the right online accounting software for your small business

10 Tips for Setting up Your QBO File for the first time

The idea of using an accounting software can be a bit intimidating for some new business owners. Others are put off by the cost when a simple spreadsheet is both free and easy. In some cases a spreadsheet makes sense when you have a simple business with very few transactions per year. However, if your business requires you to invoice your clients and customers , you want to be able to analyze the performance of the business and your time is at a premium, the monthly cost of an accounting software can be well worth it.

Quickbooks Online (QBO) is the most popular software used by small businesses. And while QBO has its pros and cons that should be evaluated before signing up, once you have decided to go ahead with it there are certain best practices that should be followed when setting up your file.

Is QuickBooks Online the Right Accounting Software for Your Small Business?

The search for accounting software can be a confusing and overwhelming process. A Google search for “small business accounting software” yields over 250 million results. Trying to get recommendations from other business owners often results in passionate discussions about why a particular program is great while another one is inadequate and lacks functionality. Your accountant might point you in the right direction, but will sometimes recommend a program that they are comfortable with using, but might be too technical and not necessarily be the best solution for your business. With so many choices out there, it can be difficult to know what to do.

13 Ways an Effective Accounting System Can Improve Business Decisions

An accounting system can be an extremely powerful tool for business owners. When structured with the specific needs of the business in mind, it has the power (through the magic of debits and credits) to convert data into a format that tells an interactive, completely personalized story about your business. By providing feedback on how your business is doing it allows you to understand its strengths and weaknesses which ultimately helps you to improve profitability, cash flow and growth of your business.

How to customize a Chart of Accounts for optimal financial reporting

A chart of accounts is the structural framework for any business accounting system. It is analogous to a filing system. If you wanted to, you could dump all your documents into one giant file in your filing cabinet (or a file folder on your computer). Of course, if you did do it this way, you would likely have a hard time locating your documents. Alternatively, you could create a series of folders, based on an organization system that makes sense for you and your business. This type of structure would make it much easier and (as long as you remember your system), much more efficient to find what you are looking for. The more precise your system, the more time you save and the easier your documents become to access. Similarly, a chart of accounts is a type of categorization arrangement for your financial data. You slot everything into a category with the ultimate goal of getting financial reports such as your balance sheet and profit-loss statement that provides valuable info to the business owner as well as the other other stakeholders of the business. It should be noted that while each chart of accounts has commonalities and some specific conventions that should be followed, there is no one size fits all. Consequently, it is important to spend some time thinking about a chart of accounts that fits the profile of your business. If you are using Quickbooks Online, you can read this in conjunction with our article on setting up QBO for the first time and watch my video on working with chart of accounts in QuickBooks Online.

How to Account for Bad Debts and Record it in Quickbooks Online and Desktop

One of the more unpleasant aspects of being a business owner is having to chase clients that do not pay. It is frustrating, stressful and disheartening, while attempts to collect are an unproductive use of time and can have a significant impact on cash flow, particularly if you are unprepared. A bad debt, in accounting terms, refers to an amount charged to a customer that is never paid. While the original sale would have been reflected as revenue, the uncollectible bad debt would then have to be written off as a separate line item on the profit and loss statement

How To Close Your Year End (or Period End)in QBO

Doing your own accounting in accounting software such as QuickBooks Online (QBO) is relatively straightforward especially if you have set up your QBO file optimally. You periodically enter invoices, expenses, bills and allocate transactions from the banking download. And while QBO is designed for non accountants, it is also equally appreciated by many accountants for its simplicity and user friendliness (although, as with any software product, there are grievances).

There does come a point, however, when you might notice that some things don’t look right. The bank balance or credit card balance might not match to the QuickBooks balance or your income and/or expenses might seem much too high or inconsistent with previous years. The solution to identifying and fixing these discrepancies is to perform what accountants refer to as year end (or month end) closing procedures, that if done properly, should correct any discrepancies that crop up. The ultimate goal of closing the books monthly or annually is to ensure that you can rely on the integrity of your data.

Should you use accounting software or a spreadsheet to track your small business finances?

Over the years my clients have come to me with their financial data in various formats. I have received shoeboxes of receipts which need to be deciphered and compiled. Some clients have given me their spreadsheets in excel, google or occasionally summaries in a word document. Others decided it made sense to use accounting software right at the outset of their businesses.

In many cases, using a spreadsheet is perfectly fine and sufficient for small business or self employed individuals where you simply need a way to determine your income and expenses. There are situations, especially when you are planning to do your own small business accounting, where it can be significantly beneficial to upgrade your record keeping from a spreadsheet to accounting software. I have enumerated some of the factors to consider when determining if your spreadsheet is enough for your accounting needs or whether it is time to upgrade.

What Are Bank Reconciliations and Why Every Business Should Do Them

Many small business and self employed owners take on the responsibility of doing their own accounting. You may do all of your own accounting from set up to preparing your own small business tax return OR you may have an accountant who simply takes care of your year end and tax reporting. Accounting software has made doing your own accounting much simpler and allows for most business owners to do it, regardless of whether they have some sort of accounting background. There is however a learning curve and certain accounting steps that not everyone is aware of and that are very important to ensure the accuracy of your books. One of these is are bank reconciliations.

How to Use QBO Class and Location Tracking to Better Analyze Your Data

A powerful, but lesser know feature of QBO is the ability to organize your data by using two separate features which are location tracking and class tracking. These features allow business owners to effectively create a higher level of categorization, in addition to their accounts, which allows for significantly better reporting and analysis.

Class and location tracking are essentially classification mechanisms that allow for reporting by an additional layer of categorization. The primary way to categorize transactions in any accounting system is to assign them to specific accounts eg. sales, purchases, computer equipment, travel, meals, office expenses etc. This is referred to as a “Chart of Accounts”. There does, however, exist two additional layers ways to categorize your transactions in QBO which work on top of the chart of accounts allowing each transaction can be grouped into a broader category. This is particularly useful for companies that have separate locations and/or divisions where they might want to see their results grouped together for deeper analysis and a better understanding of the performance of your business or organization.

19 Features to Consider When Selecting Small Business Accounting Software

A good accounting software can be an invaluable tool for businesses. Before choosing an accounting software it helps to have a detailed understanding of what your accounting system can do for you . This involves analysing the key aspects of your business, determining what is essential (eg. invoicing, expenses, banking, reports) and what you would like to have (eg. time tracking, credit card payments, banking downloads etc.). By reviewing your requirements in advance and building a checklist, you can make a better decision about something that goes to the very foundation of your business. Below are some important features to consider:

3 Online Accounting Software Options for Small Business

As cloud computing becomes ubiquitous, the number of cloud based online accounting software options continues to grow. Many small business owners want a software that has an intuitive and easy-to-use interface that allows them to bill customers, enter expenses, record bank transactions and generate financial statements and other reports,. We also want to be able to access the software from anywhere (you never know when the desire to do your accounting strikes!) and not be tied down to a specific location Below is a summary of 3 cost effective, multi functional alternatives :