Do you have to charge QST if your business is located outside of Quebec?

Quebec is unique in a number of different ways. This is great if you enjoy exposure to different types of culture and cuisine. It isn’t so great where it comes to tax. Almost every type of tax filing in Quebec requires an additional return, which often has different rules and calculations from the federal tax filings. Quebeckers are resigned to this and fortunately tax software or a good accountant tends to make the management of taxes significantly easier.

Prior to January 1st, 2019 a business, even if they had customers in Quebec, did not have to worry about Quebec based taxes as long as they did not have a physical or significant presence in Quebec. This changed on January 1st, 2019 when Quebec implemented a comprehensive set of rules for businesses located outside of Quebec, that, if they meet certain criteria, are now required to collect and report Quebec Sales Tax (QST or TVQ) on sales made in Quebec.

Frequently Asked Questions About GST/HST By Business Owners

For those of you who are starting a new business, it is essential to know your tax obligations. Every business owner must report their net profits on a either their personal tax return if they are unincorporated or a corporation tax return if they are incorporated.

In addition to income tax, it is essential to consider whether or not you should register and collect GST/HST and provincial sales taxes. There are a variety of questions around this topic:

Know Your Small Business Tax Deadlines For 2024

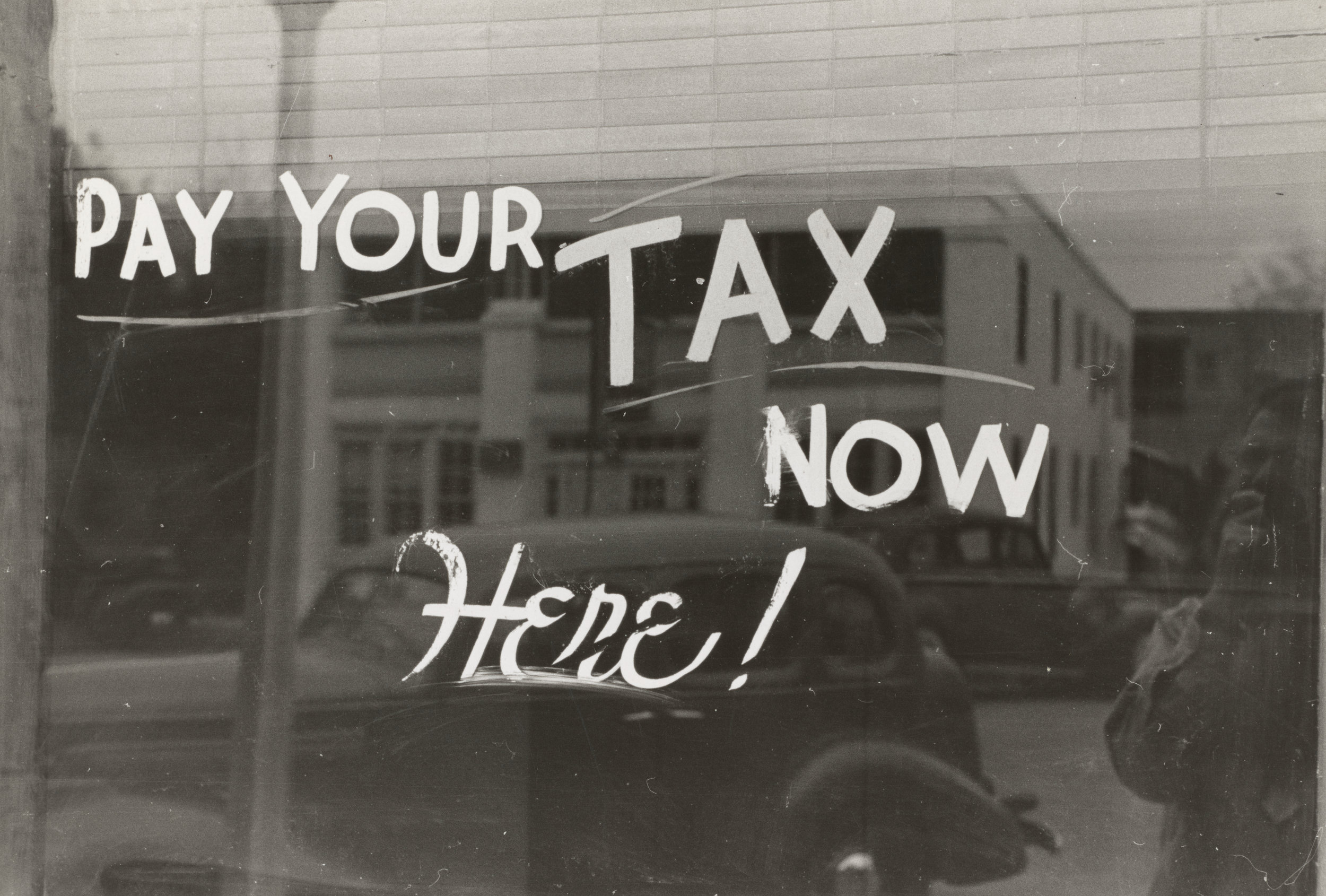

As we approach the new year, it will be time soon to start working on everyone’s favourite activity i.e. getting your tax stuff in order :) . Below are the deadlines that all small businesses need to know for 2024.

Download our free Canada unincorporated business tax deadline calendar for 2024 (both Federal and Quebec).

Should you register for GST/HST and QST and What it Means to Be Zero Rated

When starting your new Canadian small business or launching into self employment, it is essential to determine whether you are required to register for GST/HST (and QST if you have a started a business in Quebec). The simple answer is that if you anticipate that your annual gross revenues (total sales) are going to exceed $30,000 and your products or services do not qualify as Exempt or Zero rated (explained below) , then you are required to register for GST/HST and collect sales taxes from your Canadian customers and clients. The $30,000 limit applies to the last 4 quarters of revenues. If you decide not to register for sales tax upon the inception of your business/self employment, then you must monitor your sales revenues over a rolling 4 quarter period and register once you are close.

Know Your Small Business Tax Deadlines For 2023

Somehow we are almost one month into 2023 (!) and it is time for business owners (and individuals) to start thinking about one of their favourite subjects i.e. taxes. I have compiled a list of the deadlines that all of you should know and also updated my annual business tax deadline calendar.

Sign up to download our free Canada unincorporated business tax deadline calendar for 2023 or Quebec unincorporated small business tax deadline calendar 2023.

Know Your Small Business Tax Deadlines For 2022

With the beginning of a new year upon us, tax submission deadlines for individuals and businesses are starting to loom. Every small business owner must adhere to these deadlines or risk facing penalties for late filing of returns plus interest on any overdue balances. Knowing these deadlines can help you ensure that you don’t simply waste your hard earned money and run afoul of CRA and RQ. I have compiled a list of deadlines for all unincorporated small business owners which includes sole proprietors and self employed individuals.

Note that the usual deadline for sales tax (GST/HST and QST) payments and income tax returns is April 30th. However, since this falls on a Saturday, the deadline is pushed to Monday, May 2nd, 2022.

Is the Quick Method of Reporting GST/HST & QST the Right Choice for your Small Business

If you are self employed or a small business with annual sales between $30,000 and $400,000, it might make sense to select the Quick Method of reporting your GST/HST and QST, which is essentially a simplified method of reporting sales taxes . While regular reporting of sales taxes requires that you calculate all amounts collected and paid on eligible expenses, the quick method (or simplified method as it is also referred to)requires the application of a single reduced rate to your sales while GST/HST and QST paid on expenses is not deductible. The key details of the Quick Method and its suitability for your business are discussed below:

5 Reasons to Change Your GST/HST/QST Reporting Period and How to Do It

When starting a business the selection of the GST/HST or QST reporting period i.e. how often to file your sales tax returns is often based on new business considerations. Many new business owners are quite enthusiastic and/or orderly and therefore would prefer to file their reports and pay the balance owing on a more regular basis. Conversely owners might be concentrating on the other aspects of running their business and do not want to be bothered with the administrative hassle of regular monthly or quarterly reporting. In this case, you might select the annual reporting option to make the year end reporting requirements as simple as possible. As time passes and your business evolves, you might realize that the option that you initially selected may no longer be the most optimal.

Tax Filings for a Typical Canadian Small Business

When starting a business, it can be confusing and a little overwhelming to keep on top of the different types of tax filings that need to be submitted and ensuring that deadlines are met. It isn’t always clear, particularly to a new business owner, as to what the various documents from Revenue Canada or Revenue Quebec relate to., which often contains jargon that requires decoding. (for example payroll remittances are referred to as deductions at source). It can be easy to ignore these notices in favour of more pressing business related issues, which is probably the worst thing to do since the government is extremely persistent and will usually follow up with arbitrary assessments and interest and penalties. It is therefore prudent for both sole propriertorhsips and incorporated businesses to keep on top of their tax filings

How to Update Wave Accounting for the 2012 QST Rate Increase

As of January 1st, 2012 the Quebec Sales Tax (QST Rate) which had gone up from 7.5% to 8.5% on January 1, 2011 will now increase to 9.5%. The effective sales tax in Quebec will go up from 13.925% to 14.975%. Since QST is calculated on the net amount + GST, the rate is not 14.5% but 14.975% . In other words the effective QST rate is 9.75%. Business owners will need to update their invoicing and accounting systems accordingly to ensure that the rate is properly reflected.

If you are using Wave Accounting, the update to the rates is fairly straightforward, with one little quirk. Since Wave, unlike Quickbooks, does not allow for the QST to be calculated on the GST, the effective rate has to entered manually. This is done as follows:

To update Quickbooks for the tax rate increase, please see “Updating Quickbooks for the 2011 QST Increase”. The procedure is essentially identical except for rates.

How to Update Quickbooks for the 2011 QST Rate Increase

Update: As of January 1st, 2012 the Quebec Sales Tax (QST Rate) which had gone up from 7.5% to 8.5% on January 1, 2011 will now increase to 9.5%. The effective sales tax in Quebec will go up from 13.925% to 14.975%. Since QST is calculated on the net amount + GST, the effective rate is actually 14.975% (and not 14.5%) . In other words the effective QST rate is 9.975%. The instructions below are equally applicable, except the new QST rate to enter is 9.5%.

On January 1st, 2011, Revenue Quebec will be increasing the QST rate to 8.5% (yay!), bringing the effective rate of QST to 8.925% andtotal sales taxes (GST and QST) to 13.925% (since the QST is actually charged on the net price + GST.) This will impact anyone who charges QST including small businesses and self employed individuals, and invoicing software and processes should be updated to reflect the change. Suffice it to say that there are no major changes in the application of the rates. For those of you using Quickbooks you will need to update the QST being charged on both sales and purchases.